Canada Life’s UK half year financial results report record-breaking annuity sales, up 100% on the same period in 2022. May 2023 was a record month for individual annuity sales, with over £100m in new business in one month, the highest sales figure since the pension freedoms of 2015.

The company explains this performance is down to the significant rise in annuity rates over the past year, set against a backdrop of macroeconomic uncertainty driving demand from customers for guaranteed income products.

New business sales for individual annuities were £441m in H1 2023, compared to £220m in the same period in 2022.

Lindsey Rix-Broom, CEO, Canada Life UK comments:

“We’ve experienced an extraordinary come-back for individual annuities, driven by the significant increase in value offered from the returns available, combined with customers seeking income security in times of economic uncertainty. The record breaking performance of annuities has been a major driver of new business sales and the outlook for the second half of the year looks similarly very positive.

“We remain focussed on supporting our customers and communities during challenging economic times. The diversity of our business across wealth, retirement, group protection and asset management means we are well placed to meet the evolving needs of our customers and their advisers.”

Tom Evans, Managing Director, Retirement, Canada Life UK commented:

“The annuity market has been revitalised by the much better incomes now available, but there has been a quiet revolution going on since the pension freedoms were introduced. From the introduction of longer guarantee periods, 100% value protection, and more flexible retirement products, customers have an attractive alternative to drawdown to deliver the best value from their pensions. Seeking advice, shopping around, and not viewing the decision between annuity and drawdown as a binary choice can deliver a better retirement outcome.

“The unprecedented demand for annuities over the first half of the year has resulted in our teams often being stretched to deliver the service experience advisers and customers expect. I’d like to thank our teams for their hard work as we scale up our resources in this area.”

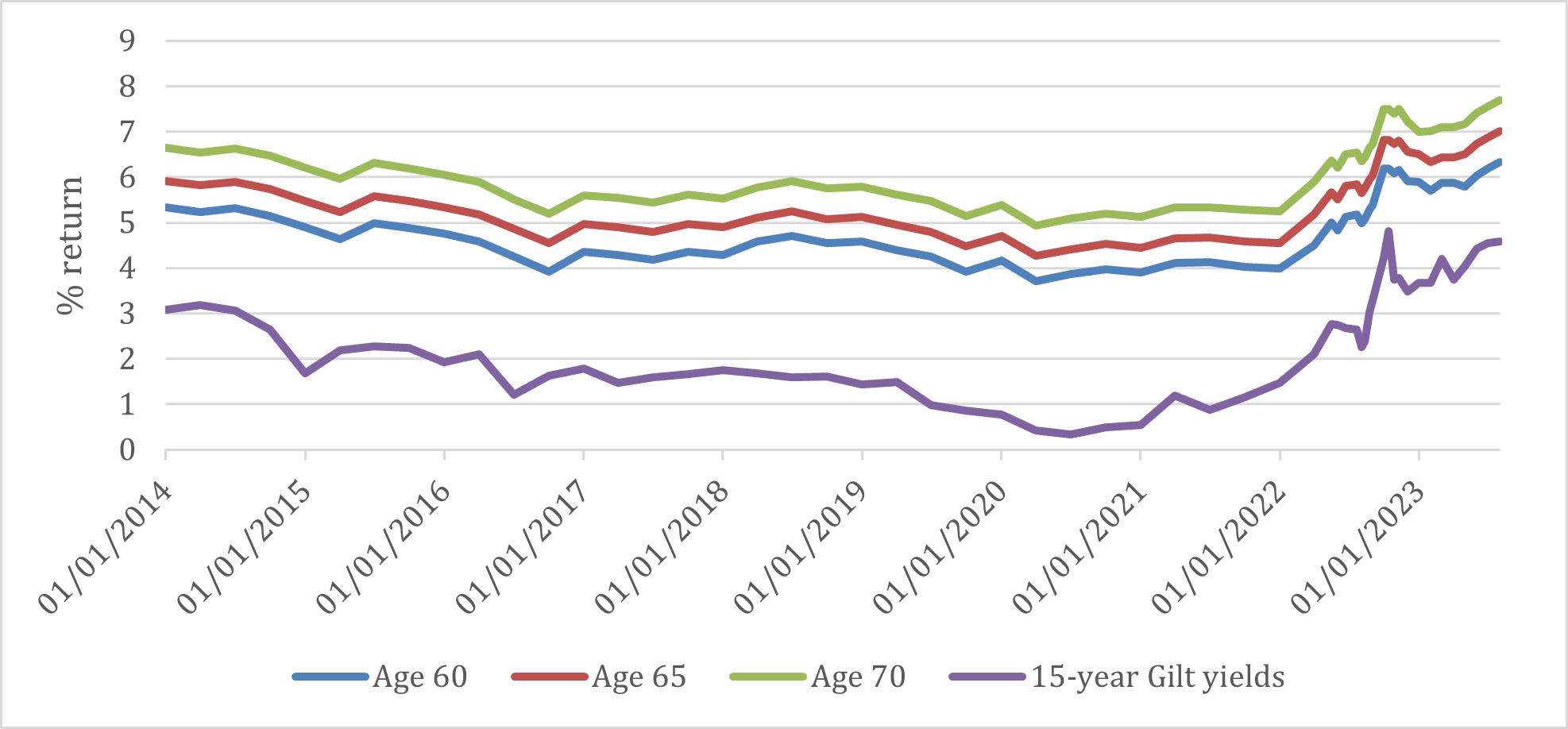

Today, a benchmark annuity for someone aged 65, with no pre-existing health or lifestyle conditions, would pay in the region of 7%1. This annuity rate can increase significantly when disclosing common health or lifestyle conditions, such as diabetes, high blood pressure or being a smoker. Age can also have a big influence on the annuity rate offered.

How lifetime annuity rates have changed over time

Source: Canada Life annuity rates over time, as at 01/08/20232

Enquiries:

Press enquiries should be directed to:

Elle McAtamney at Canada Life, elle.mcatamney@canadalife.co.uk

Notes to editors:

- Canada Life benchmark annuity rates over time, £100,000 purchase price, 10-year guarantee, no health or lifestyle factors. 15-year gilt yields sourced from ft.com.

- Further details on Canada Life’s half-year results can be found here.

About Canada Life:

Canada Life is part of a group of companies controlled by Great-West Lifeco Inc., a diversified financial services holding company headquartered in Winnipeg, Canada. Through its subsidiary companies, Lifeco has operations in Canada, the United States, and Europe. Great-West Lifeco and its insurance subsidiaries have received strong ratings from major rating agencies. Great-West Lifeco has over 38 million customers worldwide and £1.532trillion assets under administration (as at 31 December 2022).

Canada Life Limited began operations in the United Kingdom in 1903 and looks after the retirement, investment and protection needs of individuals and companies alike. As well as providing stability and security through its individual contracts, Canada Life Limited has grown to become the leading provider of competitively priced group insurance solutions. Canada Life acquired Retirement Advantage on 3rd January 2018 for an undisclosed sum. The acquisition added over 30,000 retirement income and equity release customers and more than £2 billion of assets under management including a £1.5 billion block of in-force annuities to Canada Life.

Canada Life Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Canada Life International Limited and CLI Institutional Limited are Isle of Man registered companies authorised and regulated by the Isle of Man Financial Services Authority. Canada Life International Assurance Limited and Canada Life International Assurance (Ireland) DAC are authorised and regulated by the Central Bank of Ireland.