Gifting and the 14 Year Shadow

Many advisers have heard of the 14 year rule when it comes to making gifts but are unsure when it becomes relevant. Here, we explain when this “14 year shadow” takes effect and how it is calculated.

Inheritance Tax and gifts made during lifetime

When a person makes a gift during their lifetime, for Inheritance Tax (IHT) purposes, it can be:

- Exempt, such as gifts to spouses, civil partners or charities

- a Chargeable Lifetime Transfer (CLT), which is generally a transfer into a relevant property, or discretionary, trust

or a

- Potentially Exempt Transfer (PET), which is usually a gift made between individuals or a transfer into a bare trust (or a trust qualifying as a trust for disabled person)

Chargeable Lifetime Transfers (CLTs)

A Chargeable Lifetime Transfer (CLT) is a transfer, made during lifetime, which is chargeable to IHT. When an individual makes a CLT, Inheritance Tax (IHT) could be payable immediately if the transfer exceeds the available nil rate band (NRB). This is known as the lifetime IHT or entry charge. CLTs within the NRB do not have an immediate IHT liability because although they are chargeable, the IHT rate within the NRB is 0%. CLTs are cumulative, so each CLT made over a rolling 7-year period will use up some of the NRB available for the next CLT, and so on.

This works by setting each CLT in the 7-year period against the current NRB, starting with the oldest, and once the total exceeds the NRB, an IHT charge will apply on the CLT being assessed.

CLT example

Ross plans to make a gift of £300,000 into a discretionary trust in March 2024. This is a CLT. To establish if an IHT entry charge applies, Ross needs to find out what his available NRB is, so he looks back 7 years from March 2024:

As you can see, Ross made a gift of £100,000 into a discretionary trust in 2021. This is also a CLT so he has already used £100,000 of his NRB. This means he can only gift £225,000 into the new discretionary trust without an IHT entry charge applying to it.

Ross could make the full gift of £300,000 into the new discretionary trust but instead he decides to reduce the amount of his gift to £225,000 to avoid paying this lifetime IHT charge.

If Ross made the full gift of £300,000 into the new discretionary trust, there would be a lifetime IHT charge (or entry charge) on the excess. Where an entry charge applies for a relevant property trust, a principal charge applies at the 10-year point and exit charges apply when distributions are made out to the beneficiaries.

Potentially Exempt Transfers (PETs)

When an individual makes a gift which is a Potentially Exempt Transfer (PET), there is no immediate IHT charge. While the individual giving the gift, known as the donor, is alive, PETs are ignored in the cumulation of gifts. This means there is no restriction on the amount that can be gifted. Provided the donor lives for 7 years after making it, a PET will become fully exempt and drop out of the donor’s IHT estate completely.

It is important to remember that the gift made does form part of the estate of the recipient as they have an absolute right to benefit from this gift/PET from day one.

PET example

Let’s look at Ross from our previous example. Ross plans to make a gift of £300,000 into a discretionary trust in March 2024. This is a CLT. To establish if an IHT entry charge applies on it, he needs to find out what his available NRB is, so he looks back 7 years from March 2024:

In our previous example Ross had made a gift of £100,000 into a discretionary trust in 2021. In this example, he’s made a gift of £400,000 to an absolute trust in 2021. This is, therefore, a PET and not a CLT. There was no immediate IHT charge on this PET even though it was above the NRB of £325,000.

While Ross is alive, this PET is not included in his cumulation of gifts so it doesn’t reduce the NRB available for future CLTs. So, he can gift £300,000 into the discretionary trust now without an entry charge applying to it.

The PET was made in March 2021, so provided Ross survives for 7 years (until at least March 2028) this PET will become fully exempt and drop out of his IHT estate completely.

Inheritance Tax on death

If an individual dies within 7 years of making either a CLT or a PET, these gifts fail and PETs become chargeable transfers (or chargeable gifts). Each ‘failed’ PET and CLT in that 7 year period will need to be considered when calculating the IHT liability on:

- the individual’s death estate

- later gifts and relevant property trusts

- the gift itself, which will become chargeable to IHT

How ‘failed’ PETs and CLTs interact with death estate

On the death estate, all of the failed PETs and CLTs in the 7 years prior to death become chargeable transfers. These are applied to the NRB in chronological order to determine the NRB available to the death estate.

If the NRB is used on these chargeable gifts (‘failed’ gifts made within 7 years of death only) first, the other assets in the estate could have little or no NRB to set against them. Here you can see the impact of a £225,000 ‘failed’ PET on a death estate:

Applying the NRB in chronological order to any chargeable transfers (‘failed’ PETs and CLTs) means the death estate is more likely have a charge to IHT of 40% unless the assets qualify for a relief.

If the deceased is a widow or widower, then transferable nil rate band (TNRB) may be available depending on what happened with the deceased spouse or civil partner’s estate. The residence nil rate band (RNRB) can’t be set against previous gifts, but the ‘normal’ or standard NRB can.

If all of the chargeable transfers are within the nil rate band (NRB), then there is no tax on these gifts….or is there?

How ‘failed’ PETs and CLTs affect later gifts and relevant property trusts

Most people will take steps to avoid the IHT entry charge when they make a CLT during lifetime. They can do this either by reducing the value of the CLT to the available NRB or by leaving 7 years between larger CLTs.

Sometimes this planning is disrupted if an individual makes a PET but then dies within 7 years, causing the PET to fail and become a chargeable transfer. We look back for CLTs (and other chargeable transfers) in the 7 years from the date of this chargeable transfer to find out if there is tax due on it.

If a PET becomes a chargeable transfer, it will also have an impact on subsequent CLTs (and chargeable transfers).

Failed PET example

Let’s go back and look at Ross’ situation again. For the purposes of this example, we will assume that Ross is divorced and that the NRB has remained at £325,000.

- Ross made a gift of £400,000 to an absolute trust in March 2021. This was the first gift he made and it is a PET.

- He then made a further gift of £300,000 into discretionary trust in March 2024. This is a CLT.

- Unfortunately, Ross dies in March 2027

- The March 2021 PET fails and becomes a chargeable transfer. If Ross had survived until after March 2028, then the PET would have become exempt.

We can see from the timeline below that Ross’ death has an impact on both of these gifts:

We, therefore, need to consider the IHT impact on the ‘failed’ PET as well as on the subsequent CLT. The table below shows how this affects the tax payable and who is liable:

|

IHT on failed PET (chargeable transfer) |

IHT on subsequent CLT |

|

|

In this case, the 2021 PET was ignored when looking at the cumulation of gifts during lifetime so there was no IHT entry charge paid.

If lifetime IHT had been paid on the CLT previously, for example if the CLT was more than the NRB, this can be offset against the recalculated IHT payable. If the gift was made more than three years before death, IHT taper relief may be available to reduce the IHT payable on the gift.

Remember though that if your client has paid more lifetime IHT than that due as a result of the recalculation, they cannot receive a refund.

There is a recalculation of the IHT due on all non-exempt gifts (‘failed PETs and CLTs) made in the 7 years before death. This can also impact relevant property trusts. If the recalculation means that IHT now applies for a CLT, then a principal charge will apply at the 10-year point and exit charges will apply when distributions are made out to the beneficiaries.

Find out how IHT charges are applied on relevant property trusts

IHT and the 14 year shadow

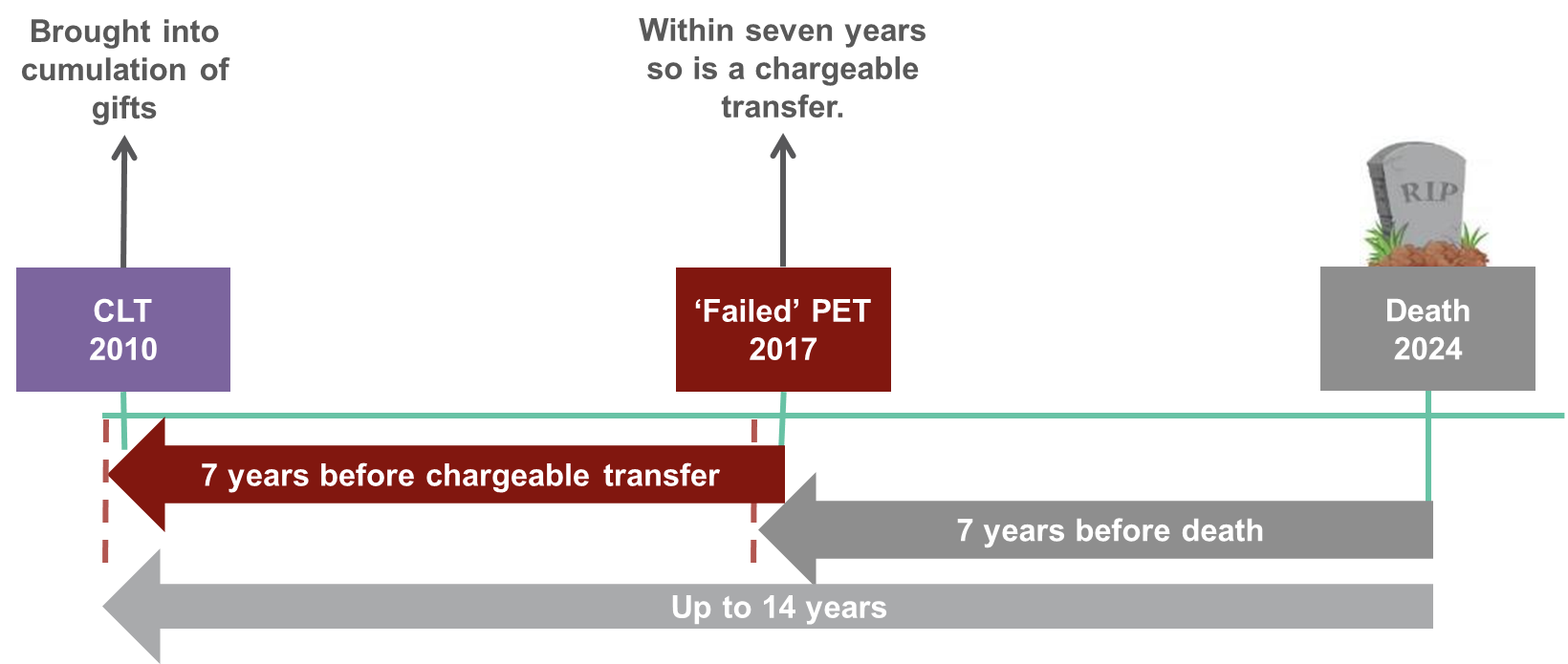

We’ve seen how ‘failed’ PETs and CLTs affect later gifts and relevant property trusts, but how and when does the 14 year shadow apply?

Chargeable transfers (CLT or ‘failed’ PET) made in the 7 years before death are liable for IHT in their own right. That’s the first 7 year period.

When working out the IHT payable on these chargeable transfers, the legislation states that you have to consider the cumulation of chargeable transfers (‘failed’ PETs and CLTs) made in the 7 years before each one. That’s the second 7 year period.

Taking both 7 year periods together means that you need to know how much of the NRB has been used on chargeable transfers (’chargeable’ gifts) for up to 14 years before death.

This is what’s known as the 14 year shadow (or sometimes the 14 year rule).

So, chargeable transfers made in the 7 years before each chargeable transfer will use up some or all of the NRB available for the next, possibly causing an IHT charge on the one being assessed.

14 year shadow example

For example, Stacey dies in 2024 having made a PET in 2017

- This PET was made within the 7 years before Stacey’s death, so it fails and becomes a chargeable transfer.

- To work out if any IHT is payable on the ‘failed’ PET, we consider chargeable transfers made in the 7 years before 2017 (the date the PET was made)

- Stacey made a CLT in 2010, this is a chargeable transfer

- The 2010 CLT uses NRB that otherwise could have been set against the 2017 ‘failed’ PET.

- If the amount of the ‘failed’ PET plus the amount of the CLT is more than the current NRB, there will be a charge to IHT. The amount of CLT used in this calculation is the gift made, not the value of it currently.

In this scenario, we looked back from 2024 to 2010, which is 14 years.

It is important to note that the NRB available to the death estate is only affected by chargeable transfers (‘failed’ PETs and CLTs) made in the 7 years before death.

The 14 year shadow (or 14 year rule) applies when calculating the IHT liability on a chargeable transfer (‘failed’ PET or CLT made in the 7 years before death).

If any chargeable transfer exceeds the available NRB, taking into account the cumulation of gifts, the excess would be taxed at 40%.

If the gift was made more than three years before death, IHT taper relief may be available to reduce the IHT payable on the gift.

IHT case study

Let’s look at a case study to bring all of this information together:

Geoffrey died suddenly in January 2024.

- His estate on death was valued at £500,000 and consisted of only savings and investments.

- Geoffrey had never married so there is no TNRB available to his estate

- In an ideal world, the IHT on his death would be the value of the excess above the NRB at that time; £500,000 less £325,000 = £175,000 taxed at 40% = £70,000.

- However, Geoffrey’s financial adviser explained to the family that, as he had made a number of gifts leading up to his death, these would now need to be considered in his IHT calculations.

- Geoffrey was using his annual exemption each year so these are not available against the gifts shown.

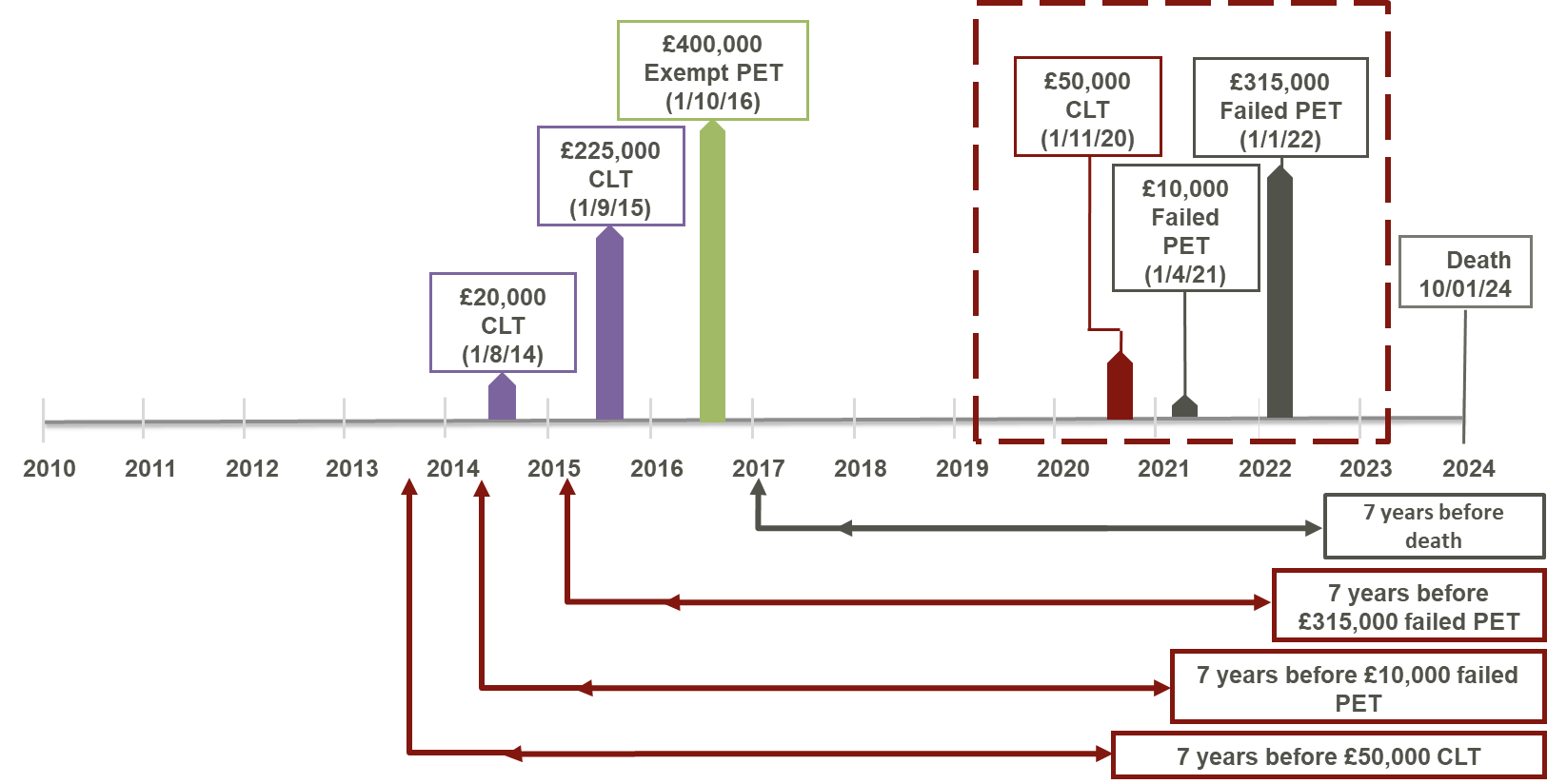

- The financial adviser drew the following timeline to explain how the gifts would interact with each other and how they would affect the death estate, before explaining how the IHT is calculated:

You can see from the timeline that Geoffrey’s gifts in the 14 years before his death were:

- A Chargeable Lifetime Transfer (CLT) of £20,000 made on 1/8/2014

- A CLT of £225,000 made on 1/9/2015

- A Potentially Exempt Transfer (PET) of £400,000 made on 1/10/2016

- A CLT of £50,000 made on 1/11/2020

- A PET of £10,000 made on 1/4/2021

- A PET of £315,000 made on 1/1/2022

How do these gifts affect the IHT payable on Geoffrey’s death estate and on each of the gifts themselves?

IHT payable on Geoffrey’s death estate

Geoffrey died on 10/1/2024 so the 3 most recent gifts are all now chargeable transfers, and possibly subject to IHT themselves, because they are within 7 years before his death.

The prior gifts, made before 2017, do not reduce the NRB available to the death estate because only chargeable transfers (‘failed’ PETs and CLTs) made in the 7 years before death affect this.

The chargeable transfers within 7 years of death are applied to the current NRB in chronological order starting with the oldest within that 7 year period, so, the reduction in the NRB for the death estate is:

|

|

Gifts |

Remaining NRB for next gift/estate |

|

Current NRB |

|

£325,000 |

|

Less CLT made on 1/11/2020 |

£50,000 |

£275,000 |

|

Less PET made on 1/4/2021 |

£10,000 |

£265,000 |

|

Less PET made on 1/1/2022 |

£315,000 |

nil |

As you can see, the NRB is fully taken up by the chargeable transfers. This means there is no NRB available to Geoffrey’s estate and the IHT due is as follows:

|

Estate |

£500,000 |

|

Less NRB |

£0 |

|

Estate liable to IHT |

£500,000 |

|

IHT rate |

x 40% |

|

IHT due on death paid by his estate |

£200,000 |

- Geoffrey never married, but if he had been a widower, then transferable nil rate band (TNRB) may have been available to his estate.

- If available, this would have been added to his NRB and could be set against the chargeable transfers within 7 years of his death.

- Geoffrey had never owned a residence so residence nil rate band (RNRB) was not available. If he had qualified for RNRB , it would be available to set against the taxable death estate.

- Importantly, even if RNRB is available, it cannot be set against previous gifts.

IHT payable on Geoffrey’s ‘failed’ gifts

Geoffrey died on 10/1/2024 so his 3 most recent gifts have ‘failed’ and are all now chargeable transfers because they are within the 7 year period before his death:

- A CLT of £50,000 made on 1/11/2020

- A PET of £10,000 made on 1/4/2021

- A PET of £315,000 made on 1/1/2022

Each of these will now need to be assessed to see if it is liable for IHT in its own right.

When working out the IHT payable, the legislation states that you have to consider the cumulation of chargeable transfers (‘failed’ PETs and CLTs) made in the 7 years before each one. These gifts, therefore, fall into the 14 year shadow.

Chargeable transfer 1

The oldest gift is the CLT of £50,000 made on 1/11/2020 and this is a chargeable transfer. The NRB available to this gift is reduced by chargeable transfers made in the 7 years before it.

This means the gifts made between 1/11/2013 and 1/11/2020 would need to be considered and will determine the 2020 CLT’s exposure to IHT. Let’s examine the gifts Geoffrey made in this period and the impact they have:

|

Gift |

Included in cumulation of gifts for 2020 CLT? |

|

CLT of £20,000 made on 1/8/2014

|

This is a chargeable transfer and is within the 7 years before the 2020 CLT, so this will be included in the cumulation. |

|

CLT of £225,000 made on 1/9/2015

|

This is a chargeable transfer and is within the 7 years before the 2020 CLT, so this will be included in the cumulation. |

|

PET of £400,000 made on 1/10/2016

|

This is a successful PET as it was made more than 7 years before death. This is fully exempt and will not be included in the cumulation. |

The reduction in the NRB for the CLT of £50,000 made on 1/11/2020 is:

|

|

Gifts |

Remaining NRB for next gift/estate |

|

Current NRB |

|

£325,000 |

|

Less CLT made on 1/8/2014 |

£20,000 |

£305,000 |

|

Less CLT made on 1/9/2015 |

£225,000 |

£80,000 |

The £50,000 CLT made on 1/1/2020 is below the available NRB of £80,000 so no IHT charge applies on this failed gift.

Chargeable gift 2

The next chargeable transfer is the PET of £10,000 made on 1/4/2021, which failed because it is within 7 years of Geoffrey’s death. The NRB available to this gift is reduced by chargeable transfers made in the 7 years before it.

This means the gifts made between 1/4/2014 and 1/4/2021 would need to be considered and will determine the 2021 CLT’s exposure to IHT. What gifts did Geoffrey make in this period and what impact do they have?

|

Gift |

Included in cumulation of gifts for 2021 CLT? |

|

CLT of £20,000 made on 1/8/2014

|

This is a chargeable transfer and is within the 7 years before the 2021 failed PET, so this will be included in the cumulation. |

|

CLT of £225,000 made on 1/9/2015

|

This is a chargeable transfer and is within the 7 years before the 2021 failed PET, so this will be included in the cumulation. |

|

PET of £400,000 made on 1/10/2016

|

This is a successful PET as it was made more than 7 years before death. This is fully exempt and will not be included in the cumulation. |

|

CLT of £50,000 made on 1/11/2020 |

This is a chargeable transfer and is within the 7 years before the 2021 failed PET, so this will be included in the cumulation. |

The reduction in the NRB for the failed PET of £10,000 made on 1/4/2021 is:

|

|

Gifts |

Remaining NRB for next gift/estate |

|

Current NRB |

|

£325,000 |

|

Less CLT made on 1/8/2014 |

£20,000 |

£305,000 |

|

Less CLT made on 1/9/2015 |

£225,000 |

£80,000 |

|

Less CLT made on 1/11/2020 |

£50,000 |

£30,000 |

The £10,000 failed PET made on 1/4/2021 is below the available NRB of £30,000 so no IHT charge is payable on this failed gift.

Chargeable gift 3

The most recent chargeable transfer is the PET of £315,000 made on 1/1/2022, which failed because it is within 7 years of Geoffrey’s death. The NRB available to this gift is reduced by chargeable transfers made in the 7 years before it.

This means the gifts made between 1/1/2015 and 1/1/2022 would need to be considered and will determine the 2021 CLT’s exposure to IHT. Let’s look at the gifts Geoffrey made in this period and the impact they have:

|

Gift |

Included in cumulation of gifts for 2022 CLT? |

|

CLT of £225,000 made on 1/9/2015

|

This is a chargeable transfer and is within the 7 years before the 2022 failed PET, so this will be included in the cumulation. |

|

PET of £400,000 made on 1/10/2016

|

This is a successful PET as it was made more than 7 years before death. This is fully exempt and will not be included in the cumulation. |

|

CLT of £50,000 made on 1/11/2020 |

This is a chargeable transfer and is within the 7 years before the 2022 failed PET, so this will be included in the cumulation. |

|

PET of £10,000 made on 1/4/2021

|

This PET failed because Geoffrey died within 7 years of making it. It is a chargeable transfer and within the 7 years before the 2022 failed PET, so this will be included in the cumulation. |

The reduction in the NRB for the failed PET of £315,000 made on 1/1/2022 is:

|

|

Gifts |

Remaining NRB for next gift/estate |

|

Current NRB |

|

£325,000 |

|

Less CLT made on 1/9/2015 |

£225,000 |

£100,000 |

|

Less CLT made on 1/11/2020 |

£50,000 |

£50,000 |

|

Less failed PET made on 1/4/2021 |

£10,000 |

£40,000 |

The £315,000 failed PET made on 1/1/2022 is above the available NRB of £40,000 so IHT charge is payable on this failed gift.

The IHT due is as follows:

|

Gift |

£315,000 |

|

Less available NRB |

£40,000 |

|

Liable to IHT |

£275,000 |

|

IHT rate |

x 40%* |

|

IHT due on chargeable gift |

£110,000 |

*There is no taper relief due as death occurred within three years of making this PET.

In this scenario the recipient of this failed PET is liable for the IHT due. They could lose up to £110,000 (almost 35%) in IHT which is probably not what Geoffrey intended.

It is a good idea to keep a clear 7 years between gifts but the need to consider previous transfers should not deter individuals from making gifts. Where there are multiple gifts over an extended period, identifying the possibility of unexpected tax on the gifts, as well as a reduction of the available NRB, is important to consider.

Therefore, care should be taken when discussing estate planning with clients.

Planning ideas

It is possible to cover any potential IHT liability on gifts within seven years of death by using a decreasing term assurance policy or having a codicil added to an individual’s will.

Key facts about gifting and IHT planning

- Consider all the client’s assets as a whole, do not plan in isolation

- Don’t forget that PETs made in the last seven years could possibly impact on new discretionary trust arrangements if the individual dies within that seven-year period

- When considering more than one arrangement then the order in which the arrangements are entered into is important

- Trusts should be established on separate days to avoid them being related settlements, as the values of related settlements are aggregated when computing charges to IHT

This document is based on Canada Life’s understandings of applicable legislation, law and current HM Revenue & Customs practice as of February 2024. It is provided solely for general consideration. The information regarding taxation is based on our understanding of current legislation, which may be altered and depends upon the individual financial circumstances of the investor. We recommend that investors take their own professional tax advice.

MAR02343 Approved on 08/03/2024