This briefing note is also available as a PDF

Taxation of investment bonds held in trust

A look at who’s liable for income tax on a chargeable event gain for a bond held in trust.

Trustees administering an investment bond in trust must be aware of who is liable for the tax charge when a gain arises due to a chargeable event. It is important to note that various factors determine who is assessed for income tax on the chargeable gain.

Investment bond taxation falls into the ‘Chargeable Event’ regime. Investment bonds are non-income producing assets and are capital in nature, but certain transactions are treated as chargeable events.

When a chargeable event occurs, a calculation is done to establish if there is a chargeable gain. Despite being capital in nature, when a chargeable gain arises on an investment bond, it is assessed for income tax as deemed income, not capital gains tax. Chargeable events occur on:

- Death of the sole or last life assured and the death benefit becomes payable

- Assignment or transfer of ownership for money or money’s worth (assignments by way of gift are exempt).

- Adding or removing a life assured once the policy has been set up.

- Maturity

- Excess withdrawals taken which are more than the available 5% tax-deferred allowance

- Surrender or encashment of the bond or individual policies within it

The underlying funds of UK investment bonds are subject to a special rate of corporation tax (or the ‘policyholder tax rate’) determined by the basic rate of income tax. As this policyholder tax rate corresponds to the basic rate, currently 20%, life funds are not affected by changes to corporation tax rates, such as the recent rise to 25% (tax year 2023/24). The tax paid on the life fund is not paid directly by the investor but as tax is deemed to have been suffered on the fund, the investor receives a non-refundable tax credit equivalent to the basic rate of income tax. Therefore, where a chargeable gain arises for a UK investment bond, it is treated as having already paid notional income tax at 20% on the gain*.

*While this basic rate tax credit cannot be reclaimed, it can be set against other taxable income where there is tax charged at the basic rate on income received. For individuals who are only liable at the starting rate for savings or the savings nil rate on that income (s530 ITTOIA 2005; s17 ITA 2007; PAYE130060), the tax credit can reduce their overall income tax liability

International bond underlying funds are not taxed, except for a small amount of withholding tax on dividends from non-UK equity funds. This means that the fund will grow virtually free of tax and this is known as gross roll up.

Chargeable gains are taxed as savings income within the income tax calculation. The chargeable gain will sit in a different position within the order of income tax calculation depending on if the chargeable gain arises for a UK or International bond.

Where an investment bond is held in trust, the trustees are the legal owners of the trust property and they administer and manage it for the benefit of the beneficiaries, as directed by the trust provisions. Trustees also need to be aware of who is liable for the tax charge when a chargeable gain arises and there are various factors to consider when determining this, including:

- the type of trust

- when the trust was established

- if the person liable is resident in the UK or not

- if the settlor(s) are still alive, and if not when they died

- if the beneficiary(ies) are minors and/or vulnerable or incapacitated

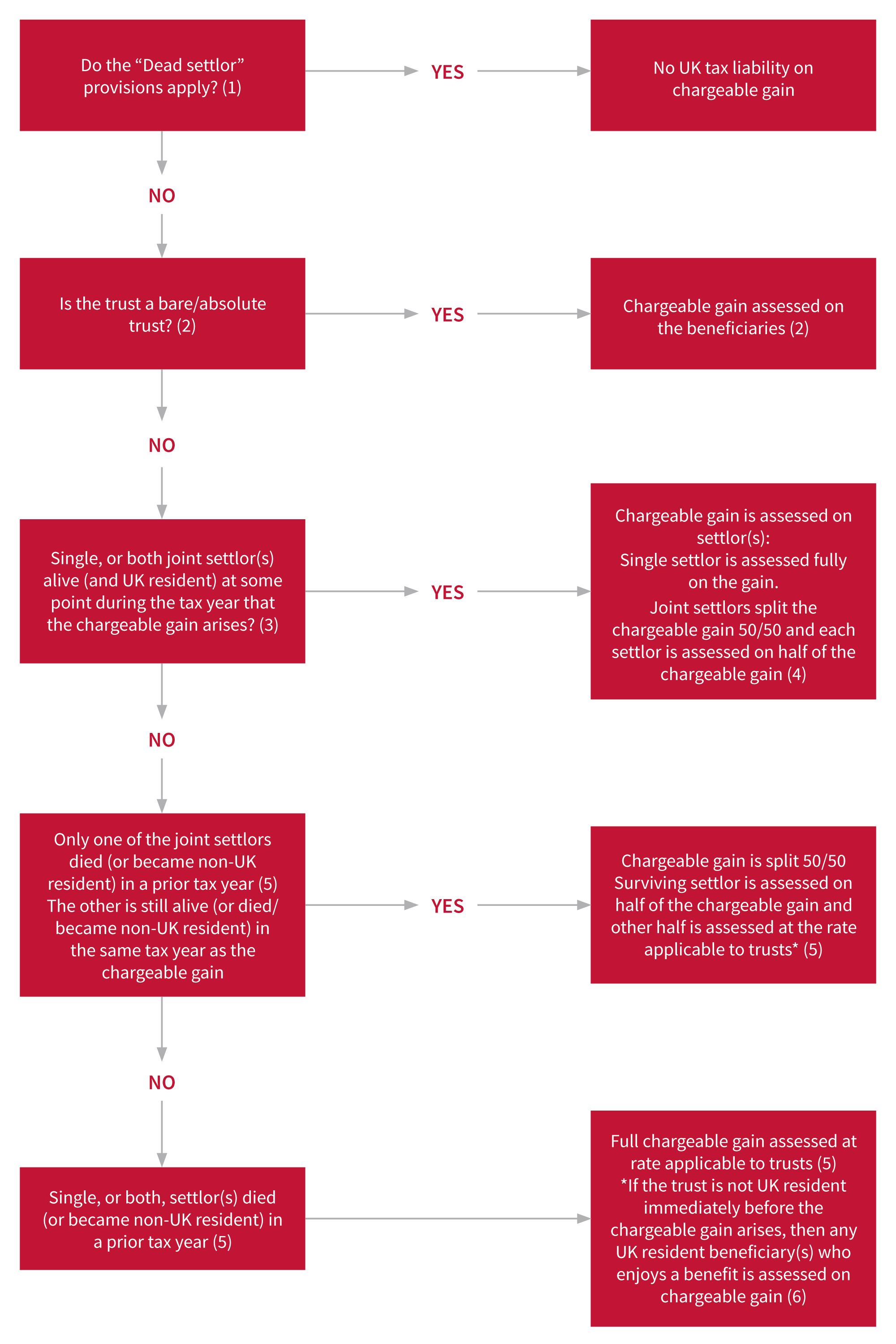

A flowchart showing who is potentially liable is on the following page. This flowchart does not cover the taxation of:

- Personal Injury Trusts

- Vulnerable Person’s Trusts

- 18 to 25 Trusts

- Trusts for Bereaved Minor

Notes

1. Dead settlor provisions for trusts established before 17 March 1998

Before 17 March 1998, only the settlor was liable to a tax charge for a chargeable gain. The settlor would only be liable if a chargeable event occurred whilst they were alive or in the tax year of their death. However, if the settlor died before 17 March 1998, in subsequent tax years there would be no-one available to be assessed for a gain and therefore no tax liability would exist. Where there were two settlors only one had to die before 17 March 1998 for there to be no tax liability to exist in a subsequent tax year. This was referred to as the ‘dead settlor rule’.

This rule changed on 17 March 1998 to the regime we are familiar with today, but the rules are not retrospective. Therefore, the dead settlor rule can still apply providing:

• the trust was created, the investment bond set up, and the settlor, or at least one of them died, before 17 March 1998; and

• the investment bond has not had any “top-up” premiums or been altered to increase the benefits or extend the term, on or after 17 March 1998.

2. Bare or absolute trust

A bare/absolute trust is one in which the beneficiary(s) has an absolute and vested interest in income and capital of the trust. The trustees’ duty is to hold the legal title to the trust property on behalf of the beneficiary and transfer it to the beneficiary as required. Whilst the beneficiary is a minor the trustees can manage the property for their benefit, in accordance with the provisions of the trust deed. The person(s) who creates the trust &/or who contributes property/funds to it, is referred to as the donor(s).

If a bare trust is established by the beneficiary’s parent(s), the parental settlement anti-avoidance rules will apply. The rules apply where the child is absolutely entitled to income (for example if money was simply paid by the parent into a children’s deposit account or the child’s entitlement is under an absolute or an interest in possession trust set up by the parent). Where this applies, parent(s) will be assessed for any income arising from that trust while the parent is alive and the beneficiary is below the legal age of majority. If the chargeable gain exceeds £100 then the whole amount will be taxed as the parent(s) income. This £100 limit is per parent, per child (including stepchildren, s629 (7)(a) ITTOIA 2005)

Otherwise, the beneficiary(ies) will be assessed for income tax on a chargeable gain as they have an absolute entitlement to the trust assets. If there is more than one beneficiary, the chargeable gain will be proportioned in line with each beneficiary’s share of the trust fund. This share of the chargeable gain will be added to the individual beneficiary’s other income to be assessed for income tax.

Beneficiaries who are non-UK resident for tax purposes will not usually have a UK tax liability but should take appropriate tax advice in their country of residence.

3. Settlor(s)

The settlor is any person(s) who has created the trust and transferred property or contributed funds to the trust - either directly or indirectly - both at the time the trust was created and at any later date. It is possible for a single trust to have multiple settlors. Where a trust is created by means of a Deed of Variation, the person(s) making the Variation will be treated as the settlor(s) for the purpose of assessing income tax on any chargeable gain(s) subsequently arising under the trust.

4. Discretionary and interest in possession trusts – settlor(s) alive

Chargeable gains are firstly assessed on the settlor provided they are UK resident and alive during the tax year that the chargeable gain arises. Top slicing relief will be available in respect of any chargeable gain assessable on the settlor (as it will for chargeable gains attributable to beneficiaries as described in 2. above).

If there is more than one settlor, the chargeable gain will be proportioned in line with each settlor’s contribution to the trust. For example, joint settlors would usually contribute the investment amount equally, so the chargeable gain would be split 50/50. This share of the chargeable gain will be added to the individual settlor’s other income to be assessed for income tax and normal top-slicing relief rules would apply.

The settlor (or their personal representatives) has a statutory right to recover, from the trustees, any additional income tax they pay in the tax year in question as a result of being assessed on any chargeable gain arising in the trust. If the settlor does not exercise this right to reclaim the tax paid, then they will be treated as having made a further transfer of value into the trust for IHT purposes. They can set their available annual IHT exemption against this.

5. Discretionary and interest in possession trusts – settlor(s) deceased

If a settlor is deceased, or is not UK resident in the tax year of the chargeable gain occurring, then their share of the chargeable gain is assessed on the trustees at the rate applicable to trusts. You can find guidance on determining UK residence for tax purposes here – https://www.gov.uk/hmrc-internal-manuals/residence-and-fig-regime-manual/rfig20000.

The proportional split between more than one settlor still applies where there are joint settlors. If one settlor died in a previous tax year, and the other is still alive, then the chargeable gain will be split and assessed 50% on the surviving settlor and 50% on the trustees.

The low income trusts regime began on 6 April 2024

This applies to trusts where trustees are liable for the income tax and the total income of the trust is below a ‘de minimus trust amount’ for the tax year. If this is the case, then no income tax is due on the net income.

The ‘de minimus trust amount’ where the settlor created one trust is £500. Where the settlor created more than one trust, then the de minimus amount is reduced by dividing the £500 available by the relevant number of trusts. The amount available cannot be less than £100 per trust.

Where trust income is above £500 for the tax year, it will not qualify for this regime and income tax will be payable on the full amount at the trustee rates:

• 45% for non-dividend income

• 39.35% on dividend income

Chargeable gains are taxed at the rate applicable to trusts, which is currently 45%. There is no top slicing relief available in this instance.

The £1000 standard, or basic, rate band for trustees was also abolished on 6 April 2024 and can now only be set against trust income received (including chargeable gains) up to and including the tax year 2023-24.

6. Residence of trust

Trusts set up prior to 6 April 2025 with no additions of property

A trust is UK resident for income tax purposes if either; a) all the trustees are resident in the UK or, b) there is a mixture of resident and non-resident trustees (where at least one trustee is UK resident and another is not) and the settlor was UK resident, ordinarily resident or domiciled at the time they transferred property to the trust (or immediately before his/her death in the case of a trust arising on the settlor’s death).

Trusts set up, or with property added, after 6 April 2025

When determining residency of these trusts, the settlor’s domicile will no longer be considered. The non-UK domicile regime was abolished with effect from 6 April 2025 and reformed to the Long Term Residence regime. All other aspects to be considered will follow the pre-6 April 2025 rules.

A professional trustee who is not resident in the UK is treated as resident for income tax purposes if they are carrying on the business of a trustee through a branch, agency or permanent establishment in the UK (TSEM10020).

If the trustees are not UK resident when the chargeable gain occurs, any UK resident beneficiary receiving a benefit from the trust derived from the transaction causing the chargeable gain will be taxed on the received amount at personal tax rates, without the advantage of top-slicing relief or credit for the tax paid within the underlying funds where a UK bond is invested.

PLANNING OPPORTUNITY

Exit strategies and managing who is liable for tax

Where the beneficiary of a discretionary trust is a non-taxpayer or pays tax at a lower rate than the trustees or settlor(s) of the trust, there is an opportunity to save income tax.

Before triggering the chargeable event, the trustees can take steps to either:

Assign the investment bond to beneficiaries

An assignment out of a trust into the ownership of a beneficiary does not cause a chargeable event. So, the trustees could assign legal and beneficial ownership of the investment bond (or specific policies within the bond) to a specific beneficiary using a deed of assignment from trustees to beneficiary.

This works well where the beneficiaries are adults as they can accept legal ownership.

After the assignment is done, the assignee beneficiary can then trigger a chargeable event and they would be assessed for income tax on any resulting chargeable gain as the outright owner.*

Appoint benefits absolutely to beneficiaries

Similar to an assignment except that only the beneficial ownership changes, not the legal ownership. The trustees appoint the investment bond (or specific policies within the bond) to an individual beneficiary using a deed of appointment to beneficiary (or to bare trust). This creates an absolute (bare) trust for the benefit of that specific beneficiary.

This works well on trusts where the beneficiaries are minors or where the legal ownership of a product cannot be assigned.

After the appointment is done, the trustees (who are still the legal owners) can then trigger a chargeable event and the absolute beneficiary would be assessed for income tax on any resulting chargeable gain. If the parent(s) of the minor beneficiary is a settlor who is still alive, then the parental settlement rules would apply, so this planning may not work.

These exit strategies minimise the exposure to higher and additional rate tax, and sometimes even basic rate tax, by:

- avoiding the tax assessment falling on the settlor

- avoiding the tax assessment falling on the trustees

- securing the beneficiary’s income tax allowances (personal allowance, personal savings allowance and starting rate for savings band) to set against the chargeable gain

- securing top slicing relief where the beneficiary is a basic rate taxpayer and the chargeable gain pushes them into the higher or additional rate tax band

* It is widely accepted that income tax on chargeable gains after an assignment is assessed against the new owner). However, there is an HMRC rule, known as transaction-related calculations, which may affect this.

Therefore, take care where withdrawals are taken before any change in ownership (assignment) within the same policy year. The withdrawals taken before the assignment may be assessed on the owner of the bond prior to the assignment.

This document is based on Canada Life’s understandings of applicable legislation, law and current HM Revenue & Customs practice as at May 2025. It is provided solely for general consideration. The information regarding taxation is based on our understanding of current legislation, which may be altered and depends upon the individual financial circumstances of the investor. We recommend that investors take their own professional tax advice.