Canada Life has crunched the numbers to show just how valuable annuity guarantees can be in delivering value over the lifetime of a customer. By choosing the right length of guarantee and shape of annuity at the outset, customers can ensure whatever happens, their annuity will return not only the original purchase value, but also a significant return on their original premium.

The analysis looks at a 30-year guarantee1, which is the longest period available, and shows a return of 73% on the original purchase price from the annuity, plus the original capital back. Selecting this option would reduce the annual income by £633 but would guarantee at least £172,861 from a £100,000 purchase price, whatever happens to the customer.

Selecting a shorter annuity guarantee period, for example, 20 years, would reduce the annual income by £252 but would deliver at least £122,860 to the customer, or the estate of the customer. Canada Life is calling for wider consideration of the various options available around death benefits from annuities, as although the latest FCA data2 shows around three out of four annuities sold come with guarantees attached, in reality most are much shorter guarantee periods, typically five or 10 years. The difference in income is negligible between no guarantee options and choosing a five year guarantee - £9 a year in this example, hence the popularity of much shorter guarantee periods.

Cost of annuity guarantee options

|

Annuity option |

Single Life – no guarantee |

Single Life – 5 year guarantee |

Single Life – 10 year guarantee |

Single Life – 20 year guarantee |

Single Life – 30 year guarantee |

Joint Life – 50% spouse |

Joint Life – 100% spouse |

Single Life – 50% value protection |

Single Life – 100% value protection |

|

Annual income |

£6,395 |

£6,386 |

£6,354 |

£6,143 |

£5,762 |

£6,389 |

£6,251 |

£5,822 |

£6,104 |

|

Max death benefit |

Nil |

£31,932 |

£63,547 |

£122,860 |

£172,861 |

£3,194 per annum |

£6,251 per annum |

£50,000 |

£100,000 |

Source: Canada Life annuity rates as at 16.04.2024, purchase price of £100,000 at age 65.

Nick Flynn, retirement income director at Canada Life comments:

“Annuities are the unsung hero of retirement income and the myriad of guarantee options should not be discounted in favour of maximising income. In times of uncertainty, annuities provide a risk-free guaranteed retirement income and if the right shape and guarantees are chosen at outset, they provide significant peace of mind for both clients and those nearest and dearest to them.

“While the shortest guarantee periods are currently chosen as the norm due to the higher incomes available, the longer guarantees effectively offering your ‘money-back’ shouldn’t be ignored, given the way the annuity market has evolved and rates improved over the past 18-months.

“Always seek the advice of an annuity specialist or regulated financial adviser before making any decisions. These professionals will help guide you through the myriad of options available, whether that be 100% value protection, longer guaranteed periods, or simply taking your health and lifestyle into account, which may result in delivering better value from your pension.”

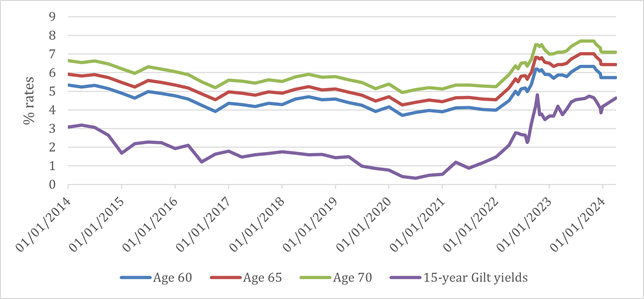

How annuity rates have changed over time

At the start of 2022, a benchmark annuity with a £100,000 purchase value would have paid an income in the region of £4,540 a year for someone aged 65 with no health or lifestyle conditions to declare. Roll the clock forward two years, that same annuity would pay around £6,431 a year, an increase of 42%, driven by rising interest rates and the returns available on gilts. Over the course of a 20-year retirement, the annuity at today’s rates would deliver around £37,820 extra income compared to an annuity sold in January 2022.

Annuity providers3 have announced strong sales, and Canada Life recently reported4 record individual annuity sales of £1.2bn for last year.

Source: Canada Life annuity rates over time, as at 17/04/20245

ENDS

Enquiries:

Press enquiries should be directed to:

Elle McAtamney at Canada Life, elle.mcatamney@canadalife.co.uk

Notes to editors:

- Source: Canada Life annuity quotes, as at 16.04.2024. Based on a purchase price of £100,000, and the relevant guarantee options available. Customer is aged 65 at the time of purchase.

- Source: FCA retirement income market data https://www.fca.org.uk/data/retirement-income-market-data-2022-23 and Canada Life annuity sales.

- Source: https://www.abi.org.uk/news/news-articles/2024/2/2023-sets-new-post-pension-freedoms-record-for-annuity-sales/

- Source: https://www.canadalife.co.uk/annual-results-2023/

- Canada Life benchmark annuity rates over time, £100,000 purchase price, 10-year guarantee, no health or lifestyle factors. 15-year gilt yields sourced from ft.com.

About Canada Life:

Canada Life is part of a group of companies controlled by Great-West Lifeco Inc., a diversified financial services holding company headquartered in Winnipeg, Canada. Through its subsidiary companies, Lifeco has operations in Canada, the United States, and Europe. Great-West Lifeco and its insurance subsidiaries have received strong ratings from major rating agencies. Great-West Lifeco has over 42 million global customer relationships worldwide and £1.52trillion assets under administration (as at 31 December 2023).

Canada Life Limited began operations in the United Kingdom in 1903 and looks after the retirement, investment and protection needs of individuals and companies alike. As well as providing stability and security through its individual contracts, Canada Life Limited has grown to become the leading provider of competitively priced group insurance solutions. Canada Life acquired Retirement Advantage on 3rd January 2018 for an undisclosed sum. The acquisition added over 30,000 retirement income and equity release customers and more than £2 billion of assets under management including a £1.5 billion block of in-force annuities to Canada Life.

Canada Life Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Canada Life International Limited and CLI Institutional Limited are Isle of Man registered companies authorised and regulated by the Isle of Man Financial Services Authority. Canada Life International Assurance Limited and Canada Life International Assurance (Ireland) DAC are authorised and regulated by the Central Bank of Ireland.

Canada Life MI & Swiss Re, 2024