Order of gifting

We explain how to plan the order of gifts for Inheritance Tax (IHT) efficiency.

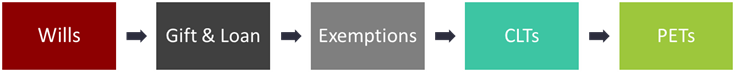

Suggested order of gifting

There is a suggested order for best tax efficiency when making gifts. When passing accumulated wealth to future generations, it is essential to consider a person’s overall assets, their history of previous gifts and the order in which any new gifts are made.

Making multiple gifts can have serious Inheritance Tax (IHT) consequences if no consideration has been given to the order in which they are made.

The following suggestions assume no Chargeable Lifetime Transfers (CLT) or Potentially Exempt Transfers (PET) have been made in the seven years before setting up any of these arrangements.

Our suggested order (with at least one day between each solution) where a number of solutions are being considered is as follows:

Wills

Wills are considered the first step in efficient estate and IHT planning. Gifts and legacies can be given or trusts can be established through a Will and these come into effect on the death of the person whose Will it is (testator or testatrix). Writing a Will and keeping it updated is important as family circumstances and dynamics change.

If someone dies without having a Will in place, succession laws and intestacy rules apply. This means that a person’s estate might not be distributed as they expected it to be. For example, under the current succession laws in England and Wales, a cohabitee has no automatic rights under intestacy. Having a valid Will allows assets to be passed as intended. A will is automatically revoked upon marriage, so new ones will need to be drawn up upon this life event. If a person has young children, or dependants, they can leave instructions to make sure those in their care are looked after by someone of their choosing. Without these provisions in a Will, it’s possible the Courts may decide who should have responsibility.

Find out how who benefits from an estate through Intestacy

Gift and loan trust

Gift and loan (G&L) trusts are set up with an initial gift of £10, which is usually covered by the £3,000 annual IHT exemption. If the £10 gift is not covered by an exemption, then it will be a CLT for discretionary trusts or a PET for bare (absolute) trusts. The settlor then gives an interest free loan to the trustees to invest and this loan is repayable on demand. Any outstanding loan amount remains in the settlor’s estate and any growth, which is for the benefit of the trust beneficiaries, is outside the settlor’s estate from day 1.

There is no transfer of value (PET or CLT) because it is a loan (and a nominal gift) to the trustees. As there is no PET or CLT when the G&L trust is created, no IHT entry charge applies to it. Despite this, discretionary gift and loan trusts still fall into the relevant property regime, so they are assessed for IHT at every tenth anniversary, or when distributions are paid to the beneficiaries. When calculating these IHT charges on the G&L trust, the nil rate band (NRB) available to it is reduced by any CLTs (including failed PETS) made in the seven years before the G&L trust commenced. This is one of the reasons G&L trusts should be considered before CLTs and PETs in the order of gifting.

Since there is no PET or CLT when a G&L trust is created, it has no impact on the available NRB for subsequent gifts or trusts*. Therefore, they do not need to be considered when calculating the 10 year principal (periodic) charge and exit charge for later discretionary trusts. This is another reason to consider a G&L trust first.

*There can be an impact if any of the outstanding loan is waived (gifted) to the trust, so care should be taken around this advice.

Use IHT exemptions

There are several exemptions available to allow gifts or transfers to be made without an IHT liability. These include:

- Spouse exemption

- £3,000 annual exemption

- Small gifts exemption

- Exemption for gifts Marriage gifts– gifts made by certain people in consideration of a marriage or a civil partnership taking place are exempt:

- from a parent: £5,000

- from a grandparent: £2,500

- from others: £1,000

- Normal expenditure out of income – lifetime gifts which are of a regular nature, and made from net income, qualify for an exemption if they do not affect the individual’s normal standard of living.

In addition to these, gifts and bequests are exempt if they are made to charities (UK registered charity or other qualifying body), for national benefit (for example the National Gallery, museums or other similar national institution which is approved for this purpose). Gifts or bequests to qualifying political parties and registered housing associations are also exempt.

Regular premium policies written in discretionary trusts

Consider if the regular premiums can be offset against IHT exemptions like the normal expenditure out of income exemption or the annual exemption. If either of these exemptions cover the regular premiums then the gifts are exempt and will have no impact on subsequent gifting.

If the regular premiums cannot be offset against exemptions, then they will be treated as CLTs for discretionary trusts or PETs for bare (absolute) trusts.

Chargeable Lifetime Transfers (CLTs)

A CLT is a transfer, made during lifetime, which is chargeable to IHT. The most common type of CLT is a lifetime gift into discretionary trust or post-2006 life interest trust (not created through a Will), which are relevant property trusts.

There may be an immediate liability to IHT when someone makes a CLT that exceeds the available NRB (this is the NRB at the time the gift is made, less prior CLTs made in the 7 years before this CLT). As well as this, as relevant property trusts are subject to IHT, so principal (periodic) charges may apply at each 10-year point and exit charges may apply when distributions are made out to the beneficiaries. When calculating these charges, the NRB is reduced by CLTs (and failed PETs) made in the 7 years before the start date of the trust. If an individual dies within 7 years of making a PET, it will fail and become a chargeable transfer.

Single premium policies written in discretionary trusts

A single premium into discretionary trust, in excess of any available exemptions, will normally be treated as a CLT.

Consideration should be given to establishing these arrangements before making outright gifts to individuals or gifting into absolute (bare) trust arrangements, which create PETs. This is because failed PETs (& CLTs) will have an impact on the NRB available, making it more likely that IHT will apply to the discretionary trust.

Potentially Exempt Transfers (PETs)

Outright gifts to individuals, gifts into absolute (bare) trusts or a trust qualifying as a trust for disabled person are PETs.

There is no immediate IHT liability on a PET and as long as the person giving the gift (donor) lives for 7 years after making it, a PET will become fully exempt and drop out of their IHT estate completely. This means that gifts classed as PETs are unlimited during lifetime.

If the donor dies within 7 years of making a PET, it fails and becomes a chargeable transfer so it has to be assessed for IHT in its own right.

A failed PET can also impact the IHT due for later gifts, discretionary and relevant property trusts, and the estate of the donor. If the NRB has been used on the failed PET, it is more likely that a principal charge will apply at the 10-year point and exit charges will apply when distributions are made out to the beneficiaries. This is the reason PETs should be considered last in the order of gifting.

Summary and key facts about gifting

When considering more than one arrangement then the order the arrangements are entered into is important:

- Make sure that Wills are written and updated first

- Next consider Gift & Loan trusts

- Then use all available IHT exemptions

- Consider CLTs next

- Trusts should be established on separate days to avoid them being related settlements, as the values of related settlements are aggregated when calculating charges to IHT

- Lastly, consider PETs

- Don’t forget that PETs made in the last 7 years could possibly impact on new discretionary trust arrangements if the individual dies within that seven-year period

The above order of gifting assumes that all arrangements are made around the same time as CLTs can affect the IHT due on failed PETs made up to seven years later (sometimes referred to as the 14 year rule).

Find out more about IHT and gifting

Our suggested order of gifting is only for consideration and the actual order depends on individual circumstances. Sometimes there is little that can be done about the order if gifts have already been made, so it makes sense to take advice before entering into any arrangements.

This document is based on Canada Life’s understandings of applicable legislation, law and current HM Revenue & Customs practice as of March 2024. It is provided solely for general consideration. The information regarding taxation is based on our understanding of current legislation, which may be altered and depends upon the individual financial circumstances of the investor. We recommend that investors take their own professional tax advice.

MKT360 Approved on 19/03/2024