Leadership

Meet the leadership team, board, and executive team driving Canada Life.

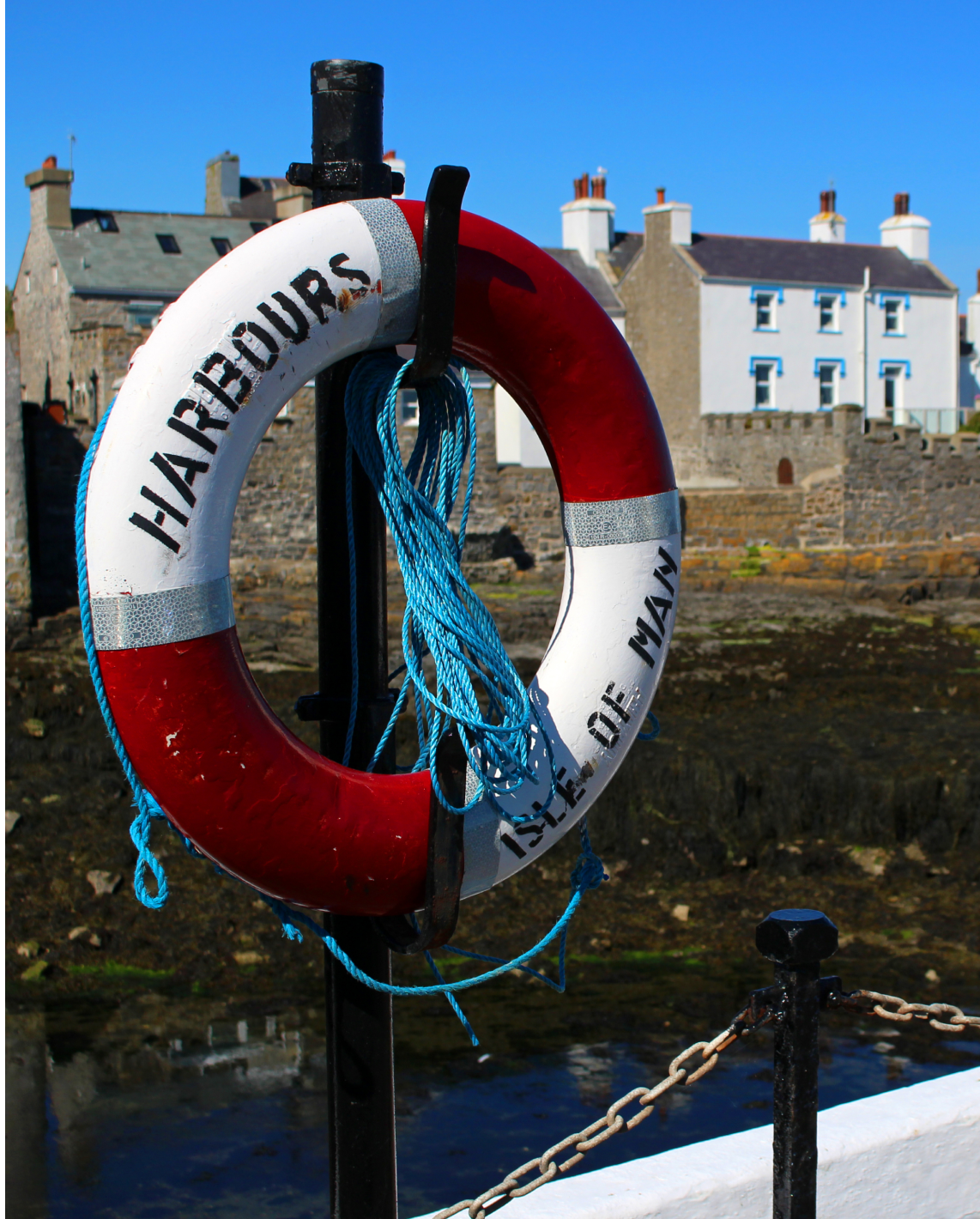

Explore our international financial centres in The Isle of Man and Ireland.

Our international business offers a variety of international solutions which are designed to grow our customers’ savings and investments. With over 35 years of unrivalled strength our international business has £28.863bn assets under administration (as at 30/09/25), with the added stability of being part of Great-West Lifeco. All of this is backed by our highly regarded service, technical expertise and award-winning products and proposition.

Canada Life International is made up of Canada Life International (CLI), CLI Institutional Limited (CLII) in the Isle of Man and Canada Life International Assurance (Ireland) DAC (CLIAI) in Ireland. Founded in the Isle of Man in 1987, our international business has offered customers stability for nearly four decades. And today, we’re recognised within the international market as a leading provider of international planning and tax-efficient solutions, including insurance, estate planning and investments. We’re proud that our international business is based in the tax efficient jurisdictions of the Isle of Man and Ireland, two of the world’s leading international financial centres.

All our international businesses are part of Great-West Lifeco, a financially strong company with roots dating back to 1847. And with the backing of this global parent and other subsidiaries, we work in partnership with financial advisers to help our customers build stronger and more financially secure futures.

Canada Life International Limited (CLI) and CLI Institutional Limited (CLII) are based in the Isle of Man and we are confident in our lasting commitment to the Isle of Man. Now one of the world’s leading international financial centres it is renowned for quality financial services and built on unrivalled accessibility and ease of communications. The Isle of Man has a reputation centred around stable government, strong regulatory controls and policyholder protection.

Canada Life International is rated 'A, Superior' for Financial Strength from actuarial consultancy firm, AKG, and has sustained five stars for all Supporting Ratings since 20151 . This rating applies to Canada Life International, Canada Life International Institutional and Canada Life International Assurance (Ireland) DAC.

CLII continues to receive exceptional ratings from specialist, independent agencies in relation to financial strength, unit-linked business, and commitment to service. Through CLII, ultra high net worth customers can obtain a level of policyholder protection, that is not otherwise currently available in the international UK market. It provides expertise in wealth management solutions for UK residents.

Both companies work in close partnership with some of the world’s largest investment specialists. We remain committed to being a strong and stable business, while growing and serving the changing needs of the market.

Canada Life International Assurance (Ireland) DAC (CLIAI) is based in Dublin, recognised as one of the world’s leading financial centres. It boasts a strong commitment to international financial standards and policyholder protection. Our aim is to provide sophisticated solutions. One of the key benefits for investors of Ireland is that there’s no VAT to pay on discretionary fund manager’s charges. We also do not pay any capital gains tax or income tax in Ireland on investments held on behalf of policyholders. We’re proud that CLIAI is given five stars by Actuarial consultancy firm, AKG. You can find more information about CLIAI in our Solvency and Financial Condition Report.

Meet the leadership team, board, and executive team driving Canada Life.

Learn more about Canada Life’s wider business and group of partnered companies.

A true reflection of the quality of a company’s proposition is the feedback, awards and ratings which it receives from those individuals and firms who recommend its product and services.