Unretire with confidence

Discover the changing landscape of mature life employment

New beginnings

Your experience and know-how make you valuable. We take a closer look at unretirement and highlight some considerations you’ll need to keep in mind when planning this next phase.

If you’ve decided to evolve your career after drawing an income from your pension, you’re not alone. Sweeping across the UK, the unretirement movement is challenging out-dated notions of employment in mature life.

There are many reasons to re-consider the traditional notion of retirement. You may be wanting to contribute your expertise, develop others, or simply supplement your income on your own terms. Whatever your reason, we’re here to provide insight into important factors that could shape how you unretire, and how you deal with working in mature life. Use our resources to explore the implications a new income may have on your pension, and more.

Helpful articles

Canada Life increase MPAA in Spring Budget

Canada Life has successfully lobbied the government to increase the Money Purchase Annual Allowance (MPAA) from £4,000 to £10,000

Find out more

Triggering the Money Purchase Annual Allowance

Here's everything you need to know about the allowance and what it means for your pension savings.

Find out more

Unretiring tips - personal finance

If you’re thinking of going back to work, it’s important to know the full picture up front. You can read what unretiring may mean for you financially below.

Find out more

Unretiring tips - wellbeing and lifestyle

If you’ve made the decision that you're going to unretire, there are things to consider both from a financial and wellbeing perspective.

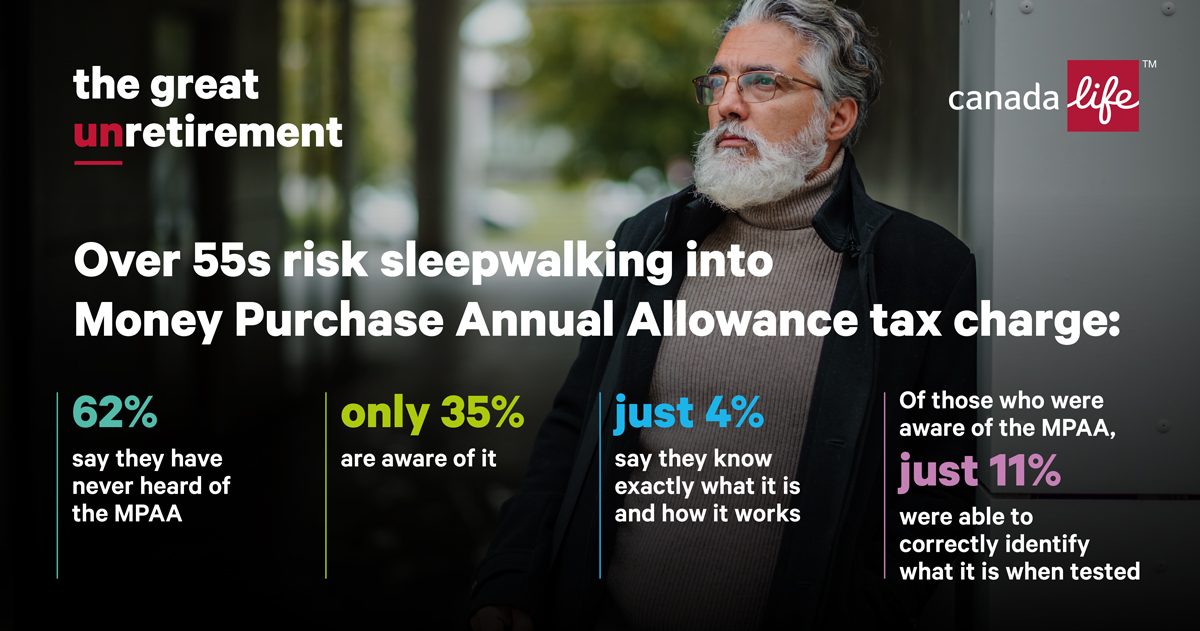

Find out moreOver 55s risk sleepwalking into Money Purchase Annual Allowance tax charge

New research shows the Money Purchase Annual Allowance (MPAA) has created a pensions tax trap for millions of over 55s. Find out more.

Frequently asked questions

Get expert financial advice

Sound advice and good planning are essential to any significant financial decision – including that of unretirement. We always recommend that you speak with a qualified financial adviser to understand your available options.