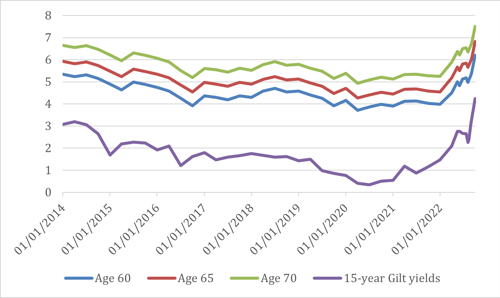

Average annuity rates have a hit a 14-year high, having increased by 52% in the past nine months, according to new data from Canada Life. This means the break-even point, the point at which you would receive your original pension back through income, has reduced by seven years, falling from 22 years to just 15 years.

A benchmark annuity of £100,000 at age 65 would now pay a guaranteed income of £6873 a year. This compares to £4521 at the start of 2022.

Inflation-linked annuity rates have also seen a significant improvement over the last nine months, with rates improving by 77%.

A benchmark £100,000 annuity linked to RPI will now pay a starting income of £3896, compared to £2195 at the start of the year.

Nick Flynn, retirement income director, Canada Life comments:

“It’s has been a record-breaking year for annuity rates, with incomes at a level we haven’t seen for over a decade. I’d need to look back to before the banking crisis of 2008/9 to see annuity rates at a similar level as today.

“In the current economic climate, where else could you receive nigh on 7% risk free income in retirement? That is how strong annuity rates are right now which is why they are worth more than just a second glance.

“With the right guarantees and value protection options, annuities can now give drawdown a good run for their money through the benefits available. Clients planning their retirements or looking to de-risk their investment portfolios should take another look at annuities.

“Clients should also look at using annuities alongside drawdown, rather than viewing in isolation or having all your eggs in the one basket. Phasing annuity purchases throughout retirement can not only de-risk your retirement journey, but you can also benefit from better annuity rates as you get older. With the right value protection, you can also ensure your wealth is protected and can be passed to loved ones.

“Anyone considering their retirement options should consult the expertise of a specialist annuity broker or the advice of a regulated financial adviser, before making any decisions.”

Source: Canada Life annuity rates as at 30.9.2022. Benchmark annuity rates for £100,000 at age 65. 10-year guarantee, single life, no escalation.

ENDS

Enquiries:

Press enquiries should be directed to:

Paul Keeble, Canada Life / paul.keeble@canadalife.co.uk/ 07833 085387

About Canada Life:

Canada Life is part of a group of companies controlled by Great-West Lifeco Inc., a diversified financial services holding company headquartered in Winnipeg, Canada. Through its subsidiary companies, Lifeco has operations in Canada, the United States, and Europe. Great-West Lifeco and its insurance subsidiaries have received strong ratings from major rating agencies. Great-West Lifeco has over 30 million customers worldwide and £1.341 trillion assets under administration (as at 31.12.21).

Canada Life Limited began operations in the United Kingdom in 1903 and looks after the retirement, investment and protection needs of individuals and companies alike.

Canada Life Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Registered in England and Wales no. 973271. Registered office: Canada Life Place, Potters Bar, Hertfordshire EN6 5BA. Canada Life Platform Limited, trading as Canada Life, is a subsidiary of The Canada Life Group (UK) Limited, and is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales no. 8395855. Registered office: Canada Life Place, Potters Bar, Hertfordshire EN6 5BA.