In times of war, we think of those less fortunate - the innocent caught up in conflict and the many displaced through the aggressive acts of a few. These are times of great uncertainty, and the unpredictability makes it difficult to see beyond the next day or two. Two years ago we counted fatalities from COVID. Today we are counting war fatalities and refugees. Now, as then, financial markets sit at a crossroad, unsure how the conflict can be resolved swiftly, peacefully, and humanely or if there is a structural change of the geopolitical guard, potentially with new actors yet to appear.

We think the answer lies between, with peak suffering still ahead on both the battlefield and in financial markets. The situation is fluid and predicting the future from the range of outcomes is tricky. What we can do is ensure portfolios are positioned to capture improvements from weak asset prices whilst investing with a firm eye on the commensurate level of risk.

As risk-targeted multi-asset portfolio managers we spend considerable time ensuring the volatility generated by your portfolio is in the appropriate range. While we normally aim to keep to the Strategic Asset Allocation in the Portfolio funds, in fast moving volatile markets we will use tactical allocation if we believe it is in the best interests of investors. This allows us to adjust exposure in your portfolios to benefit from sudden changes in global risk appetite. Discipline is needed in knowing when and how far to move portfolios underweight equities or overweight bonds or alternatives. In this way we can optimise portfolio diversification in periods of market dislocation.

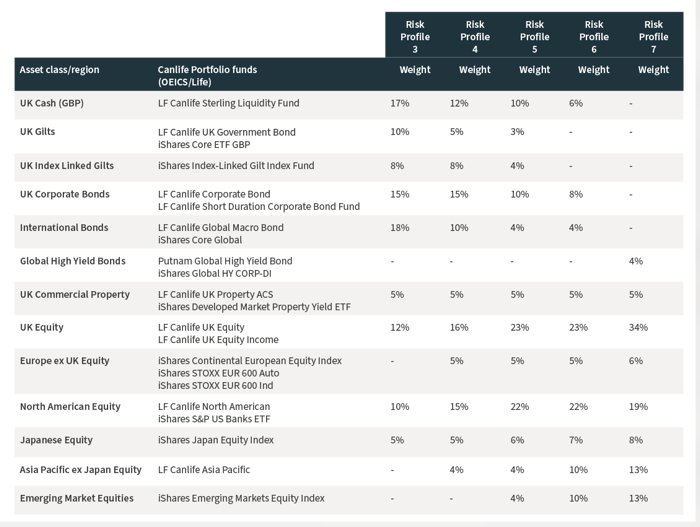

LF Canlife Portfolio III – VII fund range diversified Strategic Asset Allocation

Asset allocation

This table shows the strategic asset allocation as at 31/01/2022.

Source: Canada Life Asset Management and Dynamic Planner as at end of January 2022

Our portfolios started the year overweight UK equity income, a segment of the equity market increasingly out of favour with investors due to its allocation to energy, materials, and financials. Our position in the LF Canlife UK Equity Income fund has worked very well this year as not only has the style held up well in absolute terms but the fund has also strongly outperformed the sector. We have maintained this overweight, while now moving our overall equity weight down a little. We published an article in February exploring diversification between value and growth equity investments read more .

Within fixed income the allocations to both UK and developed market sovereign bonds and investment grade credit have reduced portfolio drawdowns since Russian troops mobilised in late February. Investment opportunities continue to appear as the war develops, and high quality but deeply discounted assets are now appearing on sale. We are continually adapting both our thinking and our portfolios as the landscape changes.

Our strategic asset allocation includes 5% in property, which we have split between directly invested property (3%) and global real estate investment trusts (REITs) (2%). Directly invested property is an excellent diversifier for quoted securities, but this comes with an increased liquidity risk. REITs afford exposure to property and minimal liquidity risk, but with an increased correlation to equities. We believe a blend of the two offers an excellent balance. We have been very positive in absolute terms towards both direct property and REITS since the second quarter of 2020, and increasingly so on a relative basis to all other asset classes as well in 2021.

This stance has played out very well in 2022 – as at 17th March 2022, the LF Canlife UK Property ACS has risen nearly 2% year-to-date. [1] Following a small rally, the global REITs solution we use is down 2.5%, comparing to world equities down around 5%.

Below you can see performance year on year by asset class. No one asset class consistently outperforms all others, so a diversified strategic asset allocation should produce a more constant less volatile performance year on year.

Patchwork quilt of investments:

Source: Equity data Bloomberg as at 16/03/2022. North American Equity represented by the Bloomberg North America Large & Mid Cap Price Return Index, UK Equity represented by the Bloomberg UK Large & Mid Cap Price Return Index, Japan equity represented by the Bloomberg Japan Large & Mid Cap Price Return Index, Asia Pac ex Japan Equity represented by the Bloomberg APC ex Japan Large & Mid Cap Price Return Index, Emerging Market Equity represented by the Bloomberg EM Large & Mid Cap Price Return Index, Europe Equity represented by the Bloomberg Europe Large & Mid Cap Price Return Index. Rebased into £ Sterling. Fixed income and property data source Morningstar as at 16/03/2022. Global Inflation Linked bonds represented by the Bloomberg Gbl Infl Linked UK TR GBP, Global bonds represented by the Bloomberg Global Aggregate TR GBP, Global high yield bond represented by the Bloomberg Global High Yield TR Hdg GBP, Sterling Corporate bonds represented by the Markit iBoxx GBP Corp TR, UK Gilts represented by the Markit iBoxx GBP Gilts TR, SD Corporate bonds represented by the Markit iBoxx GBP NonGilts 1-5 TR, Money Markets represented by the IA Standard Money Market, UK Property represented by the IA UK Direct Property sector. Rebased in £ Sterling.

The range of outcomes from the Russian invasion of Ukraine are wide. Each day brings a new set of challenges for the citizens of Ukraine, their government, European governments and international commerce. What we write today will likely have changed by tomorrow and with every additional day of conflict we move towards a more undesirable scenario plagued by instability. Germany has a big role to play in the economic conflict but is sadly conflicted by its energy dependence. This has sped up already hasty plans regarding energy supply transition. It is likely that winners, both corporate and sovereign, will emerge from this acceleration. Today we hear about new investments into liquified natural gas terminals but tomorrow it will probably be more about renewable energy.

So, what would bring a return of confidence to the people of Kyiv, the governments of Europe, the international business community, and therefore financial markets? Bears point to Russian dominance of Ukraine, the end of Russian energy purchases by Germany, and the inevitable European and possibly global inflation and recession that would ensue. A very positive alternative, however, could be a Russian miscalculation of Ukrainian resistance leading to reduced appetite to continue much further. An acceptable peace offering to Ukraine, permitting Germany to continue in some form with its Russian energy dependence, might see a powerful market rally.

Without a resolution to these matters it remains difficult for global investors to have any conviction. In that environment, we believe those employing a sensible and balanced approach to managing your multi-asset portfolios will do well.

Past performance is not a guide to future performance. The value of investments may fall as well as rise and investors may not get back the amount invested. Income from investments may fluctuate. Currency fluctuations can also affect performance.

Due to the underlying assets held, the price of the UK Equity Income fund is classed as having above average to high volatility.

Canada Life Asset Management is the brand for investment management activities undertaken by Canada Life Asset Management Limited, Canada Life Limited and Canada Life European Real Estate Limited. Canada Life Asset Management Limited (no. 03846821), Canada Life Limited (no.00973271) and Canada Life European Real Estate Limited (no. 03846823) are all registered in England and the registered office for all three entities is Canada Life Place, Potters Bar, Hertfordshire EN6 5BA. Canada Life Asset Management Limited is authorised and regulated by the Financial Conduct Authority. Canada Life Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

The views expressed in this document are those of the fund manager at the time of publication and should not be taken as advice, a forecast or a recommendation to buy or sell securities. These views are subject to change at any time without notice.

The information contained in this document is provided for use by professional advisers and is not for onward distribution to, or to be relied upon by, private investors.

The LF Canlife UK Property ACS is an Authorised Contractual Scheme and is suitable for institutional and professional investors. The fund invests in assets that may at times be hard to sell. This means that there may be occasions when you experience a delay or receive less than you might otherwise expect when selling your investment. For more information on risks see the prospectus and key investor information document.

Requests for redemptions of units are subject to a notice period of up to 185 days. In normal market conditions this notice period is waived at the discretion of the manager and units can be sold without giving notice. The value of property is generally a matter of a valuer’s opinion rather than fact. Costs of buying and selling real property are generally much higher than for other types of assets. Property investments may be subject to significantly wider price spreads than bonds and equities which could affect the valuation of the fund by up to 8.00 %.

The portfolio funds may invest in property funds that may be illiquid and subject to wide price spreads, both of which can impact the value of the fund. The value of the property is based on the opinion of a valuer and is therefore subjective.

No guarantee, warranty or representation (express or implied) is given as to the document’s accuracy or completeness.

This document is issued for information only by Canada Life Asset Management. This document does not constitute a direct offer to anyone, or a solicitation by anyone, to subscribe for shares or buy units in fund(s). Subscription for shares and buying units in the OEIC fund(s) must only be made on the basis of the latest Prospectus and the Key Investor Information Document (KIID) available at www.canadalifeassetmanagement.co.uk.

Data Source - © 2022 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

CLI02066 30th September 2022

[1] Bloomberg, bid to bid with net income reinvested for I share class