Canada Life Asset Management

Providing a range of simple investment solutions

Canada Life Asset Management (CLAM) is our UK based asset management business responsible for managing £36.0 billion (30 June 2023) of equities, fixed income and property investments including a comprehensive multi-asset range. They adopt a modern approach to provide reliable, transparent, and competitively priced funds suitable for a wide range of clients.

Canada Life Asset Management is the brand for investment management activities undertaken by Canada Life Asset Management Limited, Canada Life Limited and Canada Life European Real Estate Limited.

The Core Range within The Retirement Account draws on the investment expertise of CLAM and established asset managers such as BlackRock, Fidelity and Vanguard, to offer carefully selected options to help meet your ambitions for income, growth or a combination of the two. These include a range of multi-asset and money market funds that cater for different risk appetites and work towards specific client outcomes. Please note, The Retirement Account is closed to new customers.

Canada Life Asset Management Funds

Risk-targeted portfolios

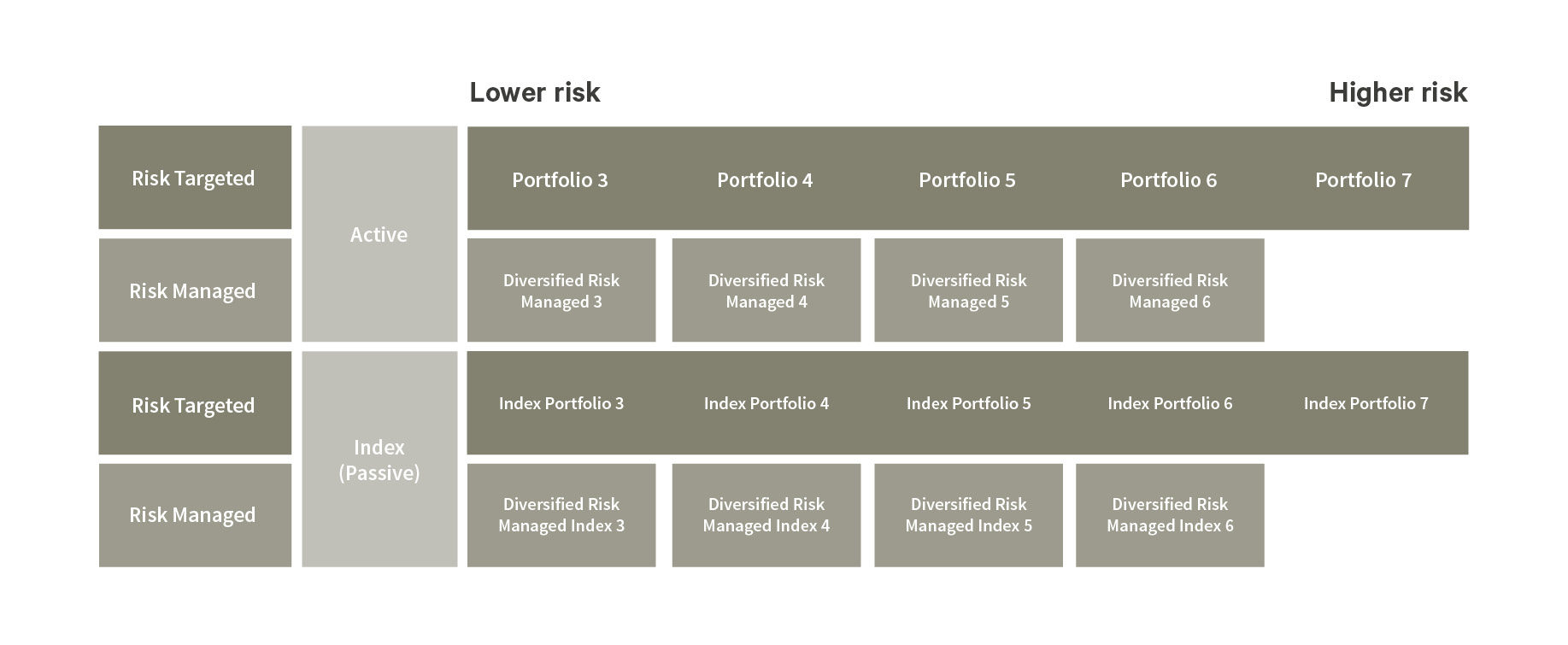

You can access 10 different risk-targeted portfolio funds from Canada Life Asset Management that invest in a wide range of asset types, countries and sectors to create a diversified investment solution. The portfolios will stay within the risk levels you are comfortable with, which means your investments will remain aligned to your risk level - both now and in the future. The active risk-targeted portfolios are 100% invested in the WS Canlife Portfolio funds, while the index funds gain exposure to the underlying asset classes via passive funds.

Risk-managed funds

Our risk-managed funds from Canada Life Asset Management allow you to benefit from their in-house fund management team and active approach to investing, while the index funds are passive trackers. This gives the fund managers flexibility to seek out growth opportunities while considering the investment options at that time. The active risk-managed funds are 100% invested in the WS Canlife Diversified Risk-Managed funds, while the index funds gain exposure to the underlying asset classes via passive funds.

Monthly Diversified Income Fund

The Canlife Diversified Monthly Income Fund is a low-cost, insured fund which has exposure to a diversified portfolio of income generating assets, including global company shares, international government and corporate bonds, as well as property. The Canlife fund is 100% invested in the WS Canlife Diversified Monthly Income Fund.

Targeting steady income with monthly dividends

- Fund aims to deliver a yield of 4% or more

- Aims for a relatively steady monthly dividend payment

- Prospect for capital growth

The fund managers select investments that they consider will provide growth in both income and capital.

Canlife Sterling Liquidity Fund

The Canlife Sterling Liquidity Fund is designed to provide investors with a high degree of capital security with daily liquidity. The fund is a vehicle for investors’ cash deposits, and the main objective is to generate a return on short-term deposits and manage cash flow efficiently. The Canlife fund is 100% invested in the WS Canlife Sterling Liquidity Fund.

CLAM - Multi-asset investment approach and fund governance

CLAM’s investment philosophy is to take a long-term approach and rise above short-term news and swings in sentiment. Simple, transparent, and competitively priced, they believe multi-asset funds should be easy to explain, have transparency around how clients’ funds are invested, and the outcomes they can expect to achieve. Their risk management and governance process includes the monitoring and assessment of fund performance, regularly challenging their investment approach and ensuring they act to deliver good customer outcomes – at all times.

Other funds in the Core Range

Visit the Fund Centre to view all funds available in the Core Range from Canada Life Asset Management, alongside other fund houses such as Blackrock, Fidelity and Vanguard.

Learn more about our risk-targeted actively managed portfolios

Fund research centre

Performance information, unit prices, fact sheets and more

Learn more about investing in the Retirement Account

The value of investments may fall as well as rise and investors may not get back the amount invested.

The WS Canlife Sterling Liquidity Fund fund is a UCITS scheme and a standard variable net asset value (VNAV) money market fund (MMF). The MMF is not a guaranteed investment, nor does it receive external support to guarantee its liquidity. Unlike bank deposits, investment in MMFs can fluctuate and investors’ capital is at risk.

The WS Canlife multi-asset funds may invest in property funds that may be illiquid and subject to wide price spreads, both of which can impact the value of the fund. The value of the property is based on the opinion of a valuer and is therefore subjective.

*Promotion approved 29/09/23