The Core Range

A range of simple, low-cost, multi-asset funds

Learn moreA range of active and passive options

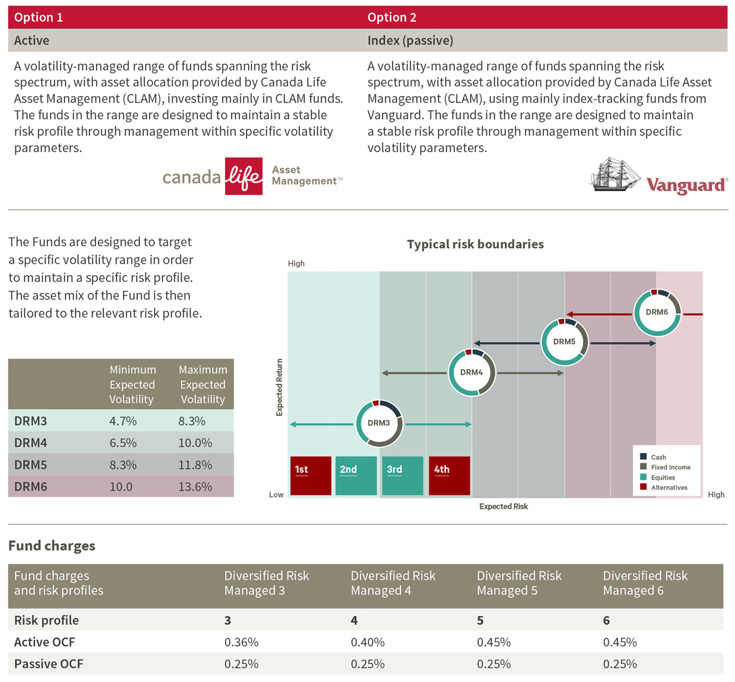

At Canada Life, our risk-managed funds can adjust risk and asset allocation within set bands, depending on the Investment Manager’s market views.

Risk-managed funds can adjust risk and asset allocation within set bands depending on the Investment Managers’ market views.

Eight risk-managed funds are available in The Retirement Account, four funds with active underlying fund exposure, and four with index tracking building blocks.

Choosing the right funds is an important process that should take into account your current situation, your goals and how you feel about risk. That’s why we insist that you use the services of a professionally qualified financial adviser who can guide you through the process.

You can find detailed information for all of our funds in our Fund Research Centre.

The value of investments may go down as well as up. Taking income or withdrawals in excess of fund growth may result in the fund running out quicker than expected. Inflation will reduce how much the Fund is worth in real terms and inflation will reduce how much your income is worth over the years. It is essential to seek advice from a suitably qualified adviser.

Get a tailored quote for this product from a financial adviser. To find one, visit Unbiased.

Use our helpful finder tool to get support information for each of our products.

Monday to Friday, 9am to 5pm