New research1 commissioned by Canada Life, among the over 50s who are at least fairly familiar with annuities, reveals their most common annuity misconceptions.

Around a fifth (20%) don’t think annuities offer good value, despite annuity rates being at a near 14-year high, having increased by almost 50% in the past 18 months.

Over two-fifths of the over 50s (44%) regard annuities as inflexible. Annuities can be flexible, with retirement account style annuities having the ability to turn income off and on as the customer needs change.

A similar 45% think annuities are risky because if you die earlier than expected, you lose money due to be paid out to you. Longer guarantees and value protection can be chosen at outset which effectively provides a ‘money back’ guarantee that if the annuitant dies early, the remaining income is paid to the nominated beneficiary.

The research also revealed a real lack of awareness and understanding beyond the misconceptions, with a significant number or people sitting on the fence with the statements being asked, despite saying they were at least familiar with annuities. For example, nearly two-fifths (39%) said they neither agreed nor disagreed that annuities offered good value, and nearly a third (31%) were unsure if annuities offered flexibility.

Nick Flynn, retirement income director at Canada Life explains:

“Annuities tend to be sold, rather than bought. This is exacerbated by the misconceptions that have built up around annuities as a product which has been out of fashion. But, they are worth more than a cursory second glance. From significantly improved rates, to longer guaranteed periods which effectively provide a money-back option, to retirement account annuities where your income can be switched on and off, there is so much more to explore with annuities than perhaps is seen at face value.

“Working with advisers, the industry needs to work harder to overcome the hurdles and provide clearer arguments to reconsider annuities. After all, they are the only game in town that can offer 100% peace of mind, that whatever happens, your retirement income will continue to be paid.”

Most 50+ year olds that are at least fairly familiar with annuities agree that they provide a guaranteed income for life (69%), that they come in many different types to fit customer needs (57%) and that they are for the rest of your life (55%).

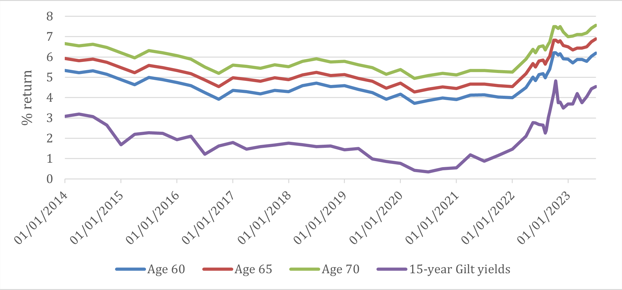

How lifetime annuity rates have changed over time

Source: Canada Life annuity rates over time, as at 01/07/20232

ENDS

Enquiries:

Press enquiries should be directed to:

Elle McAtamney at Canada Life, elle.mcatamney@canadalife.co.uk

Notes to editors:

- Source: Research among 2,000 UK adults, of which a representative sample of 955 were aged 50 and over, of which 383 50+ UK adults were at least fairly familiar with annuities - fieldwork conducted by Opinium between 28th April 2023 and 2nd May 2023.

- Canada Life benchmark annuity rates over time, £100,000 purchase price, 10-year guarantee, no health or lifestyle factors. 15-year gilt yields sourced from ft.com.

About Canada Life:

Canada Life is part of a group of companies controlled by Great-West Lifeco Inc., a diversified financial services holding company headquartered in Winnipeg, Canada. Through its subsidiary companies, Lifeco has operations in Canada, the United States, and Europe. Great-West Lifeco and its insurance subsidiaries have received strong ratings from major rating agencies. Great-West Lifeco has over 38 million customers worldwide and £1.532trillion assets under administration (as at 31 December 2022).

Canada Life Limited began operations in the United Kingdom in 1903 and looks after the retirement, investment and protection needs of individuals and companies alike. As well as providing stability and security through its individual contracts, Canada Life Limited has grown to become the leading provider of competitively priced group insurance solutions. Canada Life acquired Retirement Advantage on 3rd January 2018 for an undisclosed sum. The acquisition added over 30,000 retirement income and equity release customers and more than £2 billion of assets under management including a £1.5 billion block of in-force annuities to Canada Life.

Canada Life Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Canada Life International Limited and CLI Institutional Limited are Isle of Man registered companies authorised and regulated by the Isle of Man Financial Services Authority. Canada Life International Assurance Limited and Canada Life International Assurance (Ireland) DAC are authorised and regulated by the Central Bank of Ireland.