- Annuity incomes can improve by significant amounts following disclosure of health and lifestyle conditions

- Providing better quality information about health and lifestyle can also make a positive difference

- Common conditions which can generate a better income include smoking, diabetes and BMI

- Using online Portals to provide this medical evidence will return instant guaranteed quotes

Canada Life has looked at the improvement in annuity rates following disclosure of health and lifestyle conditions. By disclosing relatively common conditions, for example smoking, BMI and diabetes, retirement incomes can be improved. More complex health conditions can improve annuity incomes by often significant amounts. As one example1, disclosing the relatively common combination of smoking, higher BMI and type 2 diabetes could result in a customer receiving £6,300 extra income over 10 years on a £100,000 annuity.

Nick Flynn, Retirement Income Director, Canada Life, comments:

“Annuities are back in vogue following a strong year of rate improvements. But the conversation around disclosure is still key in ensuring clients secure the best possible income. Health and lifestyle play a crucial part in annuity providers calculating the best rate, so it is incumbent on the client and their adviser disclosing the full set of medical facts to providers. Only then can we, as annuity providers, give the client the best possible outcome by way of income.

“By using one of the common adviser portals advisers can get guaranteed enhanced annuities quotes instantly, just make sure the health questions are fully completed for the most accurate quote first time around.

“Annuities can play a vital role in any holistic retirement plan and seeking guidance and advice will ensure you secure not only the best rate, but also the right shape annuity for your individual circumstances.”

Case study – Richard1

Richard is 65 and has a pension pot of £100,000, therefore a standard annuity would get him £4,800 a year. By telling Canada Life he smokes, Richard gets £450 a year more, totalling £5,250 a year. By telling Canada Life he is 19 stone, Richard receives £110 more income a year, so £5,360. Finally, by revealing to Canada Life he has type 2 diabetes on treatment, Richard gets £70 per annum more, totalling £5,430, £630 a year (13%) extra guaranteed income, for life.

Case study – Julia1

Julia is 65, with a pension pot of £100,000, securing a standard annuity of £4,800 a year. Julia informs Canada Life she has had bowel cancer in the past and it is described as in-situ and no further enhancement is offered. If Rachel had provided more information, Canada Life would have known that the cancer had spread to her lymph nodes which would have secured an additional £400 a year, totalling £5,200 a year, guaranteed for life.

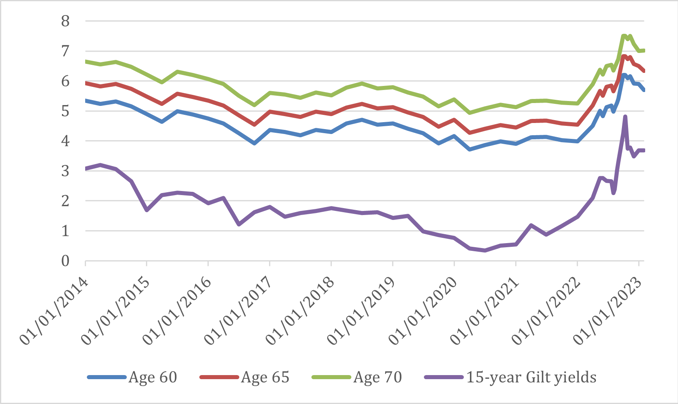

Annuity rates over time

Source: Canada Life benchmark annuity rates. £100,000 purchase price, healthy single life with 10-year guarantee. Reference 15-year Gilt yields taken from FT.com

Some pros and cons of buying an annuity

Pros

- 100% secure lifetime income, not linked to the stock market

- Your health and lifestyle could significantly improve the rate you are offered, so always disclose these to your adviser, annuity broker or annuity provider

- You can combine annuities and drawdown, it doesn’t need be an ‘either / or’ decision

- Guaranteed periods and value protection is available at a modest cost, and considerably lower cost following the significant improvement in rates

Cons

- If you die ‘early’, your estate may not get your money back, unless you have the right protection in place

- Your income will be fixed and offer no flexibility, unless you opt for some form of inflation linked escalation which can be expensive

- Don’t accept the offer from your existing pension company, always shop around the open market for the best shape and rate

ENDS

Notes to editors

- Sources: Based on Canada Life annuity rates as at 20 February 2023.

Enquiries:

Press enquiries should be directed to:

Paul Keeble, Canada Life, 07833 085387, Paul.Keeble@canadalife.co.uk

About Canada Life:

Canada Life is part of a group of companies controlled by Great-West Lifeco Inc., a diversified financial services holding company headquartered in Winnipeg, Canada. Through its subsidiary companies, Lifeco has operations in Canada, the United States, and Europe. Great-West Lifeco and its insurance subsidiaries have received strong ratings from major rating agencies. Great-West Lifeco has over 30 million customers worldwide and £1.341 trillion assets under administration (as at 31.12.21).

Canada Life Limited began operations in the United Kingdom in 1903 and looks after the retirement, investment and protection needs of individuals and companies alike. As well as providing stability and security through its individual contracts, Canada Life Limited has grown to become the leading provider of competitively priced group insurance solutions.

Canada Life Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Registered in England and Wales no. 973271. Registered office: Canada Life Place, Potters Bar, Hertfordshire EN6 5BA. Canada Life Platform Limited, trading as Canada Life, is a subsidiary of The Canada Life Group (UK) Limited, and is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales no. 8395855. Registered office: Canada Life Place, Potters Bar, Hertfordshire EN6 5BA.