Need an adviser?

Get a tailored quote for this product from a financial adviser. To find one, visit Unbiased.

There are several types of pensions available in the UK, and understanding how each works can be challenging. Use our guide to learn more about the State Pension, defined benefit and defined contribution schemes, workplace pensions, personal pensions, and more.

Please note that the information set out here is provided for guidance and education purposes only (and is not professional advice and should not be relied on). If you need help with your pension arrangements, we strongly encourage you to speak to a professional adviser. For example, an appropriately qualified FCA-regulated independent financial adviser, solicitor or tax practitioner.

For UK citizens, the State Pension is a regular payment from the government that you can claim once you reach your State Pension age, provided you have enough qualifying years of National Insurance (NI) contributions.

You’ll receive these payments every four weeks, and they’ll last for life.

The State Pension increases every year. Currently, under the pension ‘triple-lock’, it’ll rise by the higher of either:

Most experts advise that to get the most out of your retirement, you should aim to save as much as you can into a private pension, too.

When approaching your State Pension age, the government will send you a letter no later than two months before you can start claiming. This letter will let you know what your options are.

If you’re a European Economic Area (EEA) or Swiss citizen who has worked in the UK and paid NI, you might qualify for the State Pension – but it’s best to contact the International Pension Centre to learn more.

A private pension is a way for you and/or your employer to save into a pension scheme, which can be used for an income in later life. A private pension is separate from your State Pension, and works differently. You may have a private pension through your employer, or directly with a pension provider like Canada Life.

Under normal circumstances, you can access your private pension at 55 (this will change to 57 from April 2028). However, this is a minimum age, and you may not want to take your income until later in life, for example when you stop working.

Private pensions can be divided into two basic types of saving:

|

|

1. Defined benefit pension schemes |

2. Defined contribution pension schemes |

Defined benefit pensions (sometimes known as ‘final salary’ or ‘career average’ schemes) pay out a secure income for life, which increases each year. You might have one if you’ve worked for a large employer or in the public sector.

With defined benefit pension schemes, it’s typical for the employer to contribute to the scheme, and they’re responsible for making sure that there’s enough money in it to pay your retirement income. They will usually continue to pay a pension to your spouse, civil partner, or dependants when you die. Your scheme rules will determine how your pension is calculated, so always keep your membership booklet and refer to it when necessary.

The income you receive is not reliant on investment returns and is usually calculated using three elements:

For example, if you were in a defined benefit scheme for 10 years with a salary of £30,000 and the scheme accrual rate was 1/60th for each year of service, this would give you a pension of:

Whereas defined benefit pensions are a type of workplace pension (see below), they are rare nowadays. This means that most workplace pensions are structured as defined contribution schemes.

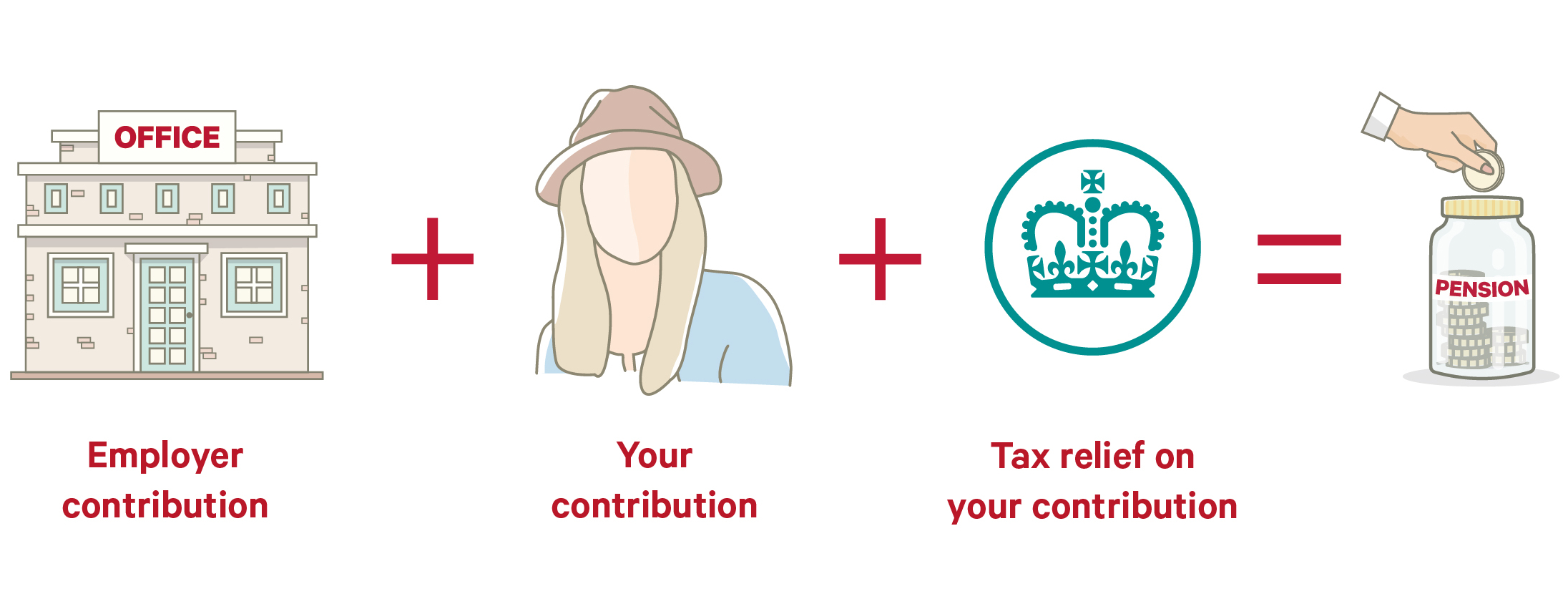

With a defined contribution pension (also known as a ‘money purchase’ pension), you build up a pot of money that can provide you with an income during retirement. Payments into your pension can come from you, your employer, or even a third-party.

To help boost your pension savings, the government will give you tax relief on any contributions you make. However, there are limits on this. For example, the maximum amount that can be paid into a pension each tax year (that qualifies for tax relief) is currently £60,000. This is known as the “annual allowance”.

Unlike defined benefit schemes, which give you a guaranteed income for life that increases every year, the income you might get from a defined contribution scheme depends on:

|

|

|

| The amount you pay in, alongside any payment your employer makes | How well your investments have performed | The choices you make when you access your money |

Please bear in mind that providers charge fees, which can also have a significant effect on the value of your pension savings, especially over time.

When your income is over a certain level, the government applies tax to your earnings. If you put money into a pension scheme, it qualifies for tax relief.

This means that in addition to the money you’re putting into your pension, some of your money that would have gone to the government as tax now goes into your pension pot instead.

This is why pensions are particularly tax-efficient, and it's one of the key advantages of a pension over other savings accounts.

Learn more about pension tax relief

To build up a defined contribution pension pot, you can invest your money in a range of different investment funds, designed to match your attitude to risk. The value of your pension can grow, but it can also fall, as with any investment.

Pension funds can be invested in different assets such as company shares (otherwise known as equities), bonds, property, cash, or other financial investment types. The value of your fund(s), and the assets within them, determines the value of your pension.

Today, most workplace and personal pensions are arranged as defined contribution schemes.

Workplace pensions are organised by your employer as a way of saving money into a pension scheme, which can then be used for an income later in life. They’re sometimes also called ‘occupational’, ‘work-based’ or ‘company’ pensions.

Essentially, a percentage of your pay is put into your workplace pension every payday, and your employer will pay in an amount alongside your contribution. Your contributions get tax relief, which means that money you would normally pay to the government as Income Tax is instead invested into your pension, boosting your savings.

If you’re employed, 22 years in age or older, earn more than £10,000 a year, and ordinarily work in the UK, your employer is required to auto-enrol you into a pension scheme. You can opt-out if you wish, although if you do so your employer will re-enrol you every three years.

The minimum contribution to your pension is typically 8% of your 'qualifying earnings'. For the 2025/26 tax year, ‘qualifying earnings’ are set between the lower limit of £6,240 and the upper limit of £50,270, meaning the maximum ‘qualifying earnings’ are £44,030.

By way of example, if your total applicable earnings in tax year 2025/26 came to £30,000, your ‘qualifying earnings’ for the purpose of pension contributions would be £23,760 (£30,000 minus £6,240).

This 8% is split as follows:

You or your employer can pay in more than the minimum. If you decide to save an additional amount into your pension, your employer may choose to match your contribution, up to a certain level. Some employers are willing to redirect this into a personal pension scheme of your choice.

It is worth noting that many employers offer more generous pension contributions than the minimum requirement detailed above. If you are unsure about the pension contribution structure that your employer offers, we recommend that you speak to your employer about this.

When joining a workplace pension, you’ll usually be able to choose how your savings will be invested. If you’re not confident choosing investments, your provider will invest in a default fund on your behalf. These are often referred to as ‘lifestyle’ funds.

Lifestyle funds will normally automatically move your savings into lower-risk investments as you near retirement age. This protects your pot from the larger fluctuations in value that higher-risk investments normally experience, but may not be suitable for those who would prefer to accept a higher level of investment risk and remain invested through retirement.

As their workplace scheme, some employers will arrange a personal pension for you with a private provider. These are called ‘group personal pensions’, ‘group stakeholder pensions’ or ‘group self-invested personal pensions’.

A personal pension is a type of defined contribution scheme you organise with a provider of your choice. You’ll arrange your contributions with your provider, who’ll then administer your pension for you.

People normally pay into their personal pensions regularly, but some providers will let you pay in lump sums on an ad-hoc basis. This means that a personal pension can give you flexibility if you’re self-employed or have an uncertain income.

You can have both a personal pension and a workplace pension at the same time, but it often makes financial sense to pay into your workplace pension first, as this is where your employer’s contributions will go. Some employers may be willing to contribute into your personal pension.

Your provider will offer you a choice of funds to invest in, and the aim is to grow your fund over time. People often choose to invest in multiple funds, spreading their investment risk over a broad range of assets. This is known as diversification.

A default fund will be available if you don’t feel confident in selecting your own . Additionally, non-workplace personal pensions can offer ‘investment pathway’ funds, designed for savers who don’t have a financial adviser, but want to remain invested as they get closer to retirement.

As with any defined contribution scheme, you get tax relief on your payments into your pension. Your provider will automatically claim 20% tax relief on your behalf. If you pay higher or additional marginal Income Tax rates, you’ll need to claim the extra pension tax relief from HM Revenue and Customs (HMRC).

How much you contribute, and how well your investments perform, will be central in determining the value of your pension pot. Providers also charge fees, which can have a significant effect over time.

Employers can use a personal pension for their workplace pension. This is called a ‘group personal pension’.

Personal pensions include both self-invested personal pensions (or SIPPs) and stakeholder pensions.

What are pensions and how do they work?

Get a tailored quote for this product from a financial adviser. To find one, visit Unbiased.

Use our helpful finder tool to get support information for each of our products.

Monday to Friday, 9am to 5pm