ican academy

Develop your professional knowledge and skills. Get the right support from our industry-recognised experts.

Start the Life100+ conversation and help your clients make the most of a longer life.

A key finding in our first Life100+ report is that preparing well for later life is imperative. By planning appropriately and leveraging the power of conversation – most especially in the areas of close relationships and financial advice – people will be in a much better position to take advantage of the benefits additional years may bring.

Download our report to learn more about how you can help your clients navigate the opportunities and challenges brought about by improving longevity.

We’re proud to present our first Life100+ report, Exploring longevity to build financially secure futures.

Learn more about the key roles intergenerational relationships and financial advice will play as we plan for a longer later life.

We’ve found that many people haven’t given much thought to their later years, and that a lack of preparedness will hamper their ability to live comfortably.

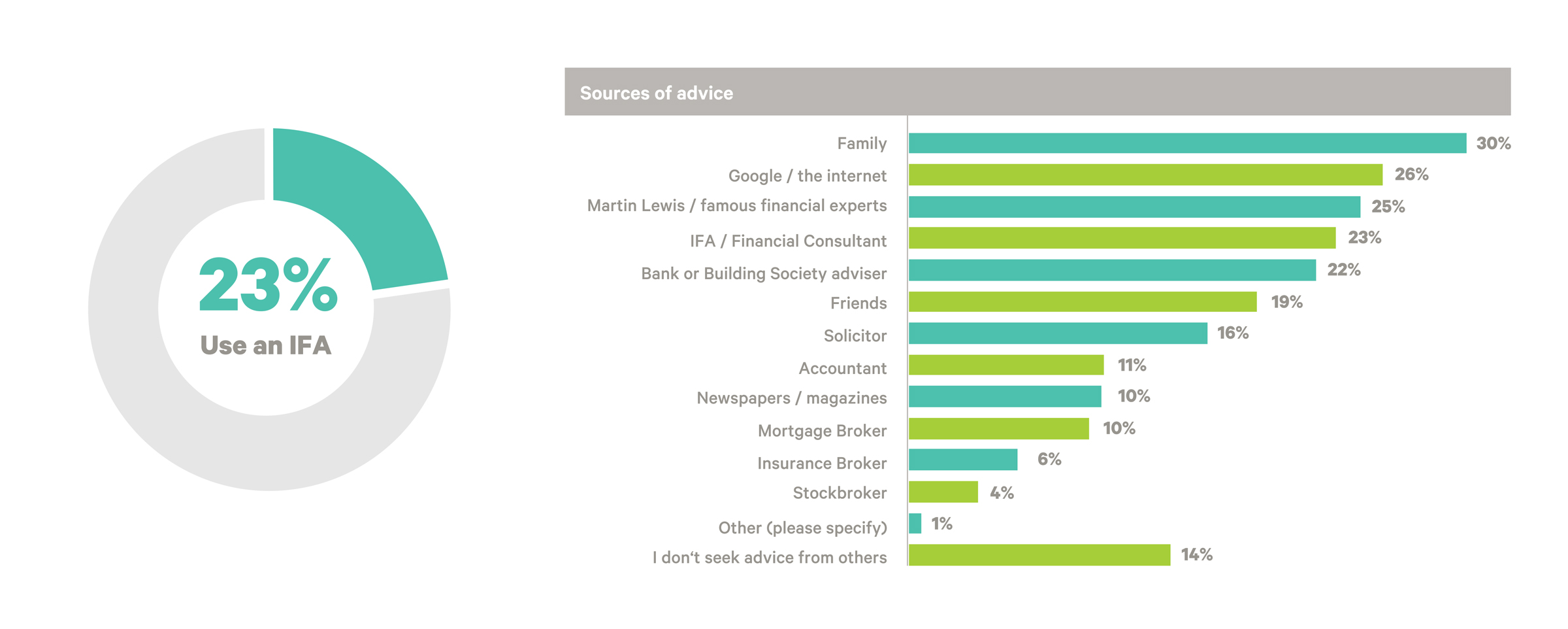

This issue is compounded by the fact that only 23% of our respondents have ever used an adviser.

Our research shows that having a sense of control over one’s life is strongly correlated with life satisfaction. Nine in ten (90%) of those who say they feel in control are satisfied with life, compared with just two-thirds (65%) overall.

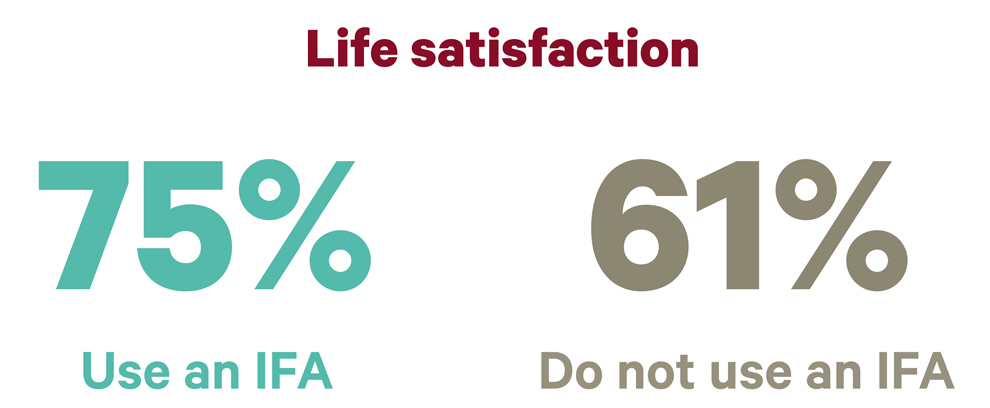

People who receive financial advice feel more in control, and three-quarters (75%) of those who use an adviser are satisfied with their life, compared with six in ten (61%) of those who don't use an adviser.

HumanSense is here to help you understand the behavioural psychology behind meaningful client-adviser conversations.

Comprising of six modules, with each focusing on a relevant soft skill topic, HumanSense is CPD qualifying.

Develop your soft skills to create better outcomes for your clients.

Many people haven’t had any discussions with their family about later life and inheritance. Yet, doing so strongly relates to life satisfaction and feeling in control. This is just one of the areas where you can add value for your clients.

Part of our aim for Life100+ is to highlight the importance of these conversations and demonstrate the advantages they can bring.

As an expert partner to advisers, we provide you with quality support resources, along with information and tools to share with your clients.

Develop your professional knowledge and skills. Get the right support from our industry-recognised experts.

Access our useful Consumer Duty resources, designed to help you deliver good outcomes for your clients.

Find answers to commonly asked questions, helpful links, tools and contact details.

New research from Canada Life finds that the majority of UK adults (56%) who received an inheritance sum over the past five years did not discuss its value with the benefactor beforehand.

Almost one in five (19%) 18–34-year-olds have used, or plan to use, inheritance they’re expecting to buy a property.

We’re proud to present our first Life100+ report, Exploring longevity to build financially secure futures.

*Canada Life UK commissioned independent research from the Big Window ® Consulting. All fieldwork was conducted during May-July 2024 with a representative sample of 3,400 UK adults aged 18 and over.