Need an adviser?

Get a tailored quote for this product from a financial adviser. To find one, visit Unbiased.

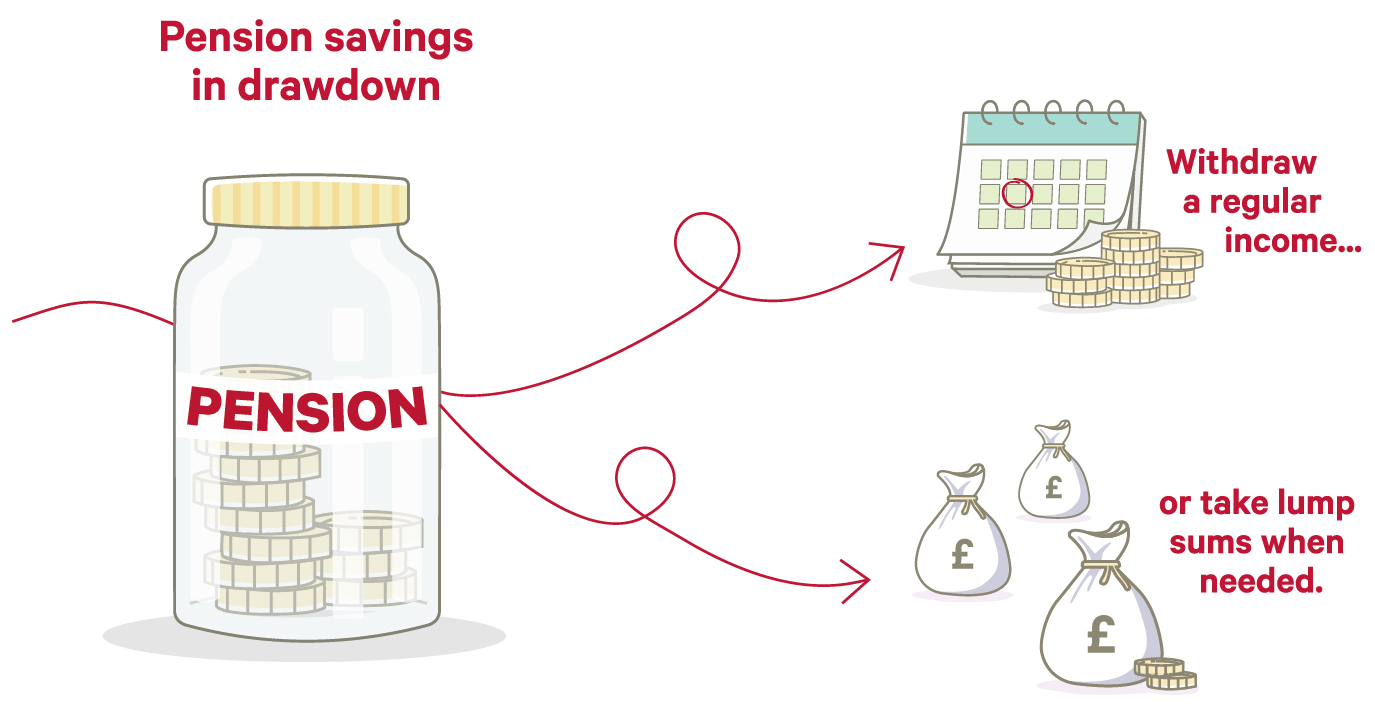

Pension drawdown, also known as flexi-access drawdown or flexible retirement income, gives you the freedom to choose when and how much to withdraw from your pension.

Pension drawdown is a way for you to take an income from your pension when you decide to retire. Your pot stays invested, and you withdraw money from your pension savings when it best suits you.

As drawdown gives you the freedom to choose when and how much to withdraw, it’s also called flexible retirement income, flexi-access drawdown, or income drawdown.

But, because your retirement income is taken directly from your pension fund, you risk running out of money if you don’t plan carefully.

|

|

|

Potential growth |

Flexible access |

Future options |

|

Your pot is invested, giving it the opportunity to grow in value.1 This could provide protection against the effects of inflation. |

You can withdraw money from your pension as and when you need it. Take regular income or draw lump sums on an ad hoc basis. |

If your situation changes, you can convert your drawdown pension, or part of it, into guaranteed income at a later date. |

At Canada Life UK, we only provide drawdown to our existing customers. Your pension provider will be able to tell you if they offer drawdown. If they do, it’s still important to shop around to ensure you’re getting the right solution for your individual circumstances.

We always recommend speaking with a financial adviser before making key decisions about your financial future.

To put your pension savings into a drawdown:

A defined contribution scheme is a type of pension where you contribute a portion of your income to build up a pot of money. If you’re employed full time, your employer will also make payments into your pension.

These are common nowadays, but you may have a ‘defined benefit pension’ if you’ve worked for the government or a large employer in the past.

Learn more about defined contribution and defined benefit pensions.

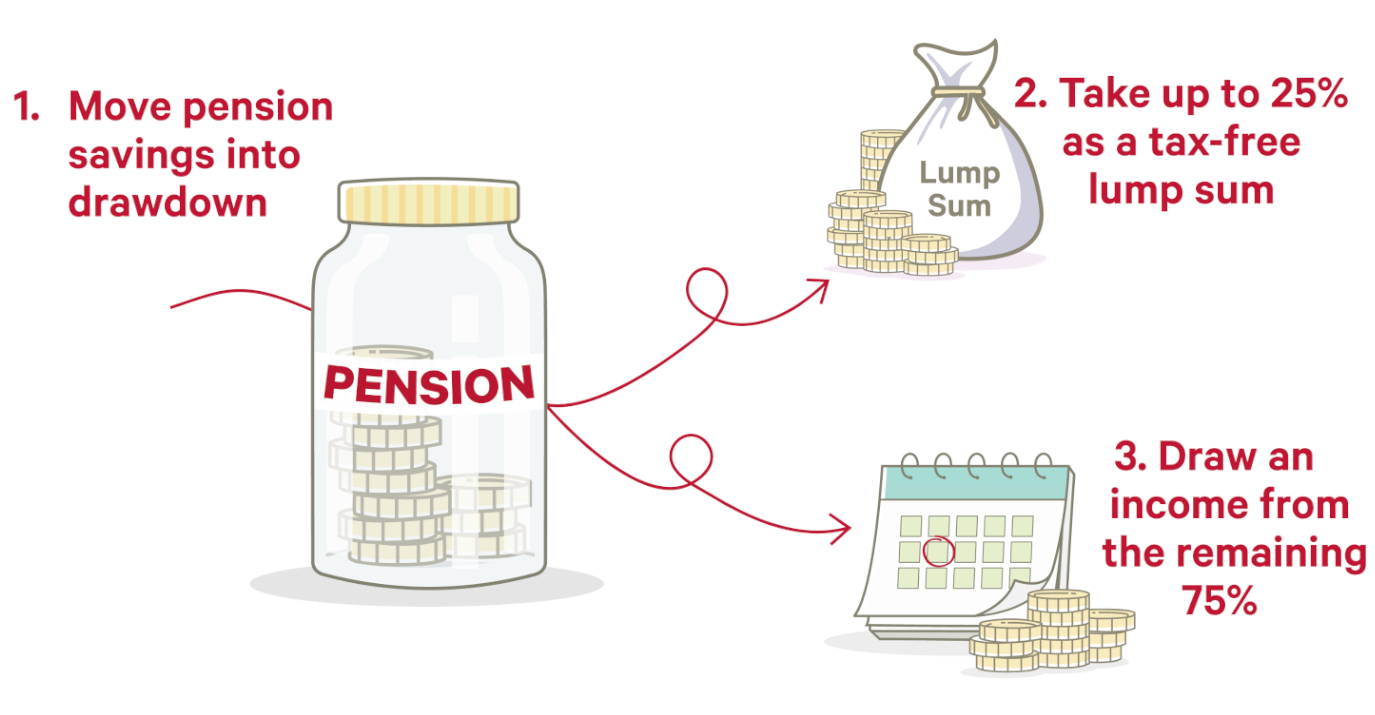

You have a range of choices when it comes to moving your pension pot into drawdown.

When you move your pension, or portions of it, into drawdown, you’re able to take a tax-free lump sum. This is called a Pension Commencement Lump Sum (PCLS), or ‘tax-free cash’.

‘Tax-free cash’ is a benefit of saving into a UK-registered pension scheme. In total, you’re allowed to access up to 25% of your pot tax free, up to a limit of £268,275. This means you can take a lump sum from your pension when you move money into drawdown – and not pay tax on it.

For example, let’s assume your pot is £100,000 and you’d like to put the entire amount into drawdown:

If you move money into drawdown in phases, you can take up to 25% of the total amount you’re accessing each time as tax-free cash. Staying with the above example, if you decide to initially move only half of your £100,000 pot into drawdown, you can:

Your pension remains invested while it’s in drawdown. This gives it the opportunity to grow, possibly protecting its buying power against rising prices. However, investments can fall in value, too. If this happens, you’ll have less to draw an income from.

We strongly recommend getting professional pension advice from a qualified financial adviser before making any lasting decisions. An adviser will look at your entire financial situation and work with you to tailor a solution that best meets your individual needs – including how you should invest your pension when it’s in drawdown.

Learn more about how you might benefit from pension advice.

Many providers offer ‘investment pathways’ – an initiative started by the Financial Conduct Authority (FCA) in 2021. The pathways are designed to help those who move their pensions into drawdown before obtaining professional pension advice. There are four pathways, each with a different set of investments aligned with when you plan to start drawing on your pension.

Drawdown is often seen as an alternative to an annuity. When you buy a Lifetime Annuity, you’re exchanging some, or all, of your pension savings for a regular, guaranteed income that’ll last for life. This protects you against running out of money.

However, if you choose drawdown, your income is taken directly from your pension fund – which means you could run out of money if you don’t plan carefully.

You can convert funds in drawdown into an annuity at any time if your situation or preferences change. Unfortunately, you won’t be able to turn an annuity into a drawdown arrangement.

We suggest speaking with a financial adviser to find out which option will best suit your individual circumstances.

An UFPLS (pronounced ‘uf-plus’) is an ‘Uncrystallised Funds Pension Lump Sum’. The name may be a bit complicated, but the basic idea is quite straightforward.

What are ‘uncrystallised funds’?

Money you’ve saved into your pension pot is in an uncrystallised state until you decide to access a pension benefit. The funds that you use for the benefit then become ‘crystallised’. So, if you decide to:

the portion of your pension savings you use for these then becomes crystallised. Any portion that you haven’t used for the above remains uncrystallised.

An example will help make this clear.

Let’s say you’ve saved £100,000 into your pension, and you haven’t yet accessed any funds. In this case, the entire amount is uncrystallised.

If you then decide to take a £12,500 tax-free cash lump sum and put £37,500 into drawdown (see above), the total amount of £50,000 will have been crystallised. The other £50,000 – that you haven’t done anything with – will still be uncrystallised.

How does an UFPLS work?

Essentially, with an UFPLS, you’d take a lump sum directly from your uncrystallised savings without buying an annuity or putting funds into drawdown.

You can take your entire pot in one go, or you can keep taking lump sums until your savings are depleted.

This is the important bit: 25% of each lump sum is tax-free (up to a limit of £268,275), but the other 75% is added to your income for the year and taxed at your marginal rate. For example, if you take an UFPLS of £10,000:

An UFPLS can result in you paying significant tax on your pension, especially if you withdraw large sums.

By comparison, when you move pension savings into drawdown, you can 1.) access your tax-free cash and 2.) avoid withdrawing taxable income at the same time.

This is why tax-free cash is different to an UFPLS, and it’s what really sets drawdown apart from an UFPLS.

Your savings will be paid to your chosen beneficiary(ies) who will usually pay no income or Inheritance Tax. Normally, your beneficiary(ies) will be able to take the money as a lump sum, or leave it in drawdown and take an income or lump sums when needed.

Your pension savings will be paid to your beneficiary(ies); but they will pay Income Tax at their marginal rate if they decide to take it as a lump sum. Alternatively, they can decide to keep the money in drawdown – and pay no Income Tax until it is withdrawn. Inheritance Tax won’t normally apply.

Page footnotes:

Get a tailored quote for this product from a financial adviser. To find one, visit Unbiased.

Use our helpful finder tool to get support information for each of our products.

Monday to Friday, 9am to 5pm