The Retirement Account

Learn more about our flexible pension plan where your clients have the option to combine a pension drawdown and guaranteed income.

With the recent market volatility, we’ve seen lower-risk clients often suffer greater falls in their fund values than higher-risk clients. This is due to their more significant exposure to fixed-interest holdings. Simply put, as yields have increased, capital values have fallen. But increased yields have also fuelled the rise in annuity rates.

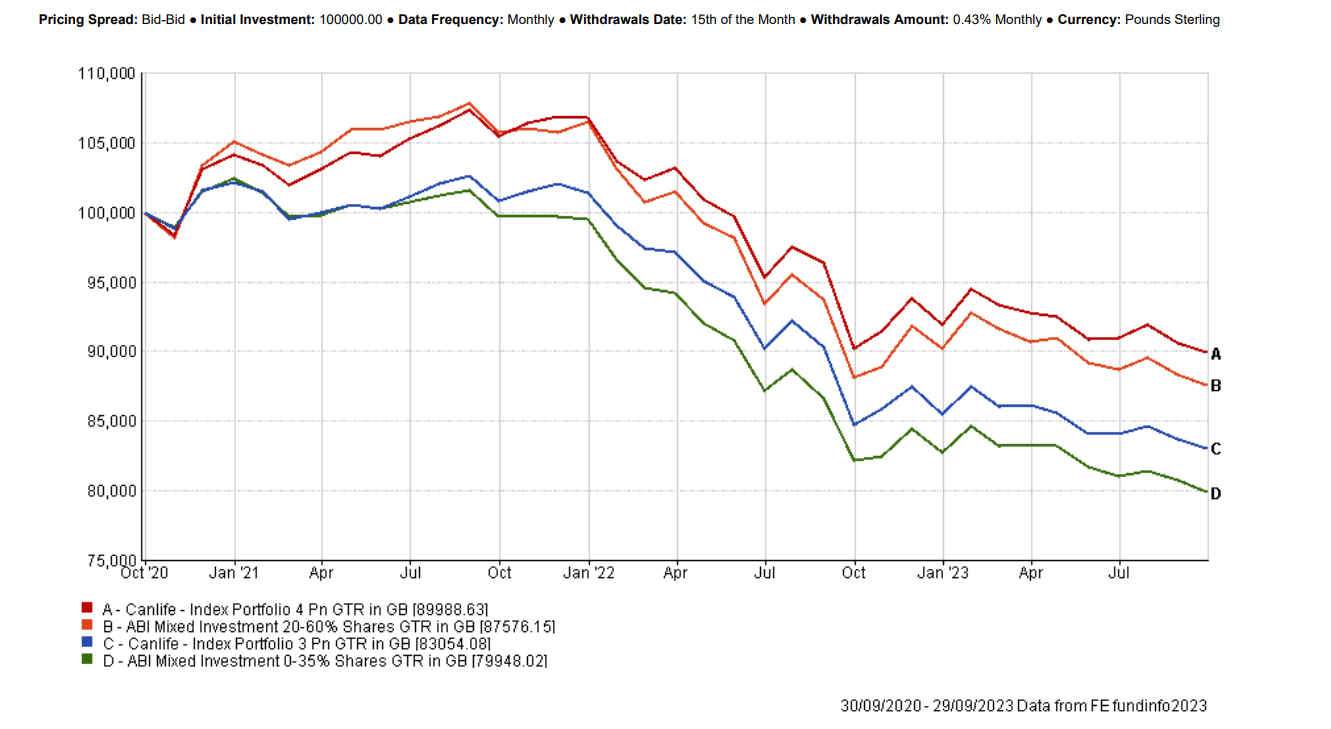

If we go back just three years and consider a client with a risk profile of 3 or 4, who was taking regular withdrawals of 5% of the original investment, their outcomes would resemble the chart below.

Please note that this chart only illustrates the investment impact of taking regular withdrawals from a fund falling in value, so we’ve made no allowance for product charges or adviser fees.

Moreover, we’re using our multi-asset index portfolios, which have performed well over the period compared to their sector, which is also shown.

For a client withdrawing a regular income, our funds have outperformed their sectors despite the unfavourable market conditions.

Importantly, the above chart also shows that for a client who has received £15,000 of income over the period, even the risk level 3 fund is only marginally down (£98,054) once the withdrawn income is added back in.

If we look at these falls and consider what an average drawdown client would have experienced over the period, it provides some interesting insights.

For this example, let’s assume they have £200,000 after tax-free cash and withdraw 5% of the original investment per year (£10,000).

Had the client used their £200,000 to purchase a level, single life annuity with a 10-year guarantee (assuming they were 65), the income they could have received in October 2020 would have been £9,600pa.

This isn’t that much less than the £10,000 they elected from drawdown, but it was at a point in time when annuity rates were almost at an all-time low.

However, with a fund value now at £160,000 (the sector average return, ignoring any impact from product fees and charges), their £10,000 is an effective deduction of 6.25% rather than the original 5%.

With cost-of-living increases, it’s not likely that a client would want to reduce their income.

Interestingly, the impact of higher annuity rates means that, at present, buying an annuity with the £160,000 could result in the client receiving an income of £10,720pa.

This gives them more income than the current drawdown strategy, without the strain of taking 6.25% from the fund going forward.

This only works due to the rapid rise in annuity rates. Had the rates stayed the same as they were in October 2020, then the annuity that the client could have got three years later would only have been £6,800pa from the £160,000.

To be clear, in this example, the prevailing rates are increasing the client’s income by nearly £4,000pa when compared to what they could have received just three years ago.

It’s also worth noting that the rise in annuity rates has had a far greater impact than waiting to get a better rate as you get older.

Delaying an annuity purchase in the hopes of securing a better rate later means that your clients could miss out on receiving income. This is the "cost of delay” – and it should, at this point, be a key consideration.

As shown above, the rates for a 65-year-old are of course higher than those for a 60-year-old. But the rise in underlying rates is driving the increases, not age.

If we go back further in time, we can see just how dramatic this is. Again, this is a single life, level annuity, with a 10-year guarantee.

The reality is that against a backdrop of inflation, a careful blend of annuity and drawdown may prove the best way forward.

This blended approach allows a client to use the annuity to cover day-to-day expenses, but keep drawdown funds available for non-essential spending. The drawdown account will also enable a client to have an invested fund to hedge against inflation.

With that in mind, let’s not forget that low-cost risk target managed funds have worked throughout this turbulent period, as evidenced earlier.

Taking advantage of the present annuity rates as part of a longer-term strategy that blends drawdown and a secured lifetime income could provide a real alternative due to current rates. However, annuities do have some drawbacks that the Retirement Account could help solve.

Within the Retirement Account is the option to use a guaranteed income. It sits within the drawdown account and whilst you can’t have all the options you can from an annuity, such as GMP, the rates are aligned with our annuity rates. This guaranteed income is paid into the SIPP bank account, under drawdown rules. This means the clients receive one income payment, which can be a combination of drawdown and guaranteed income. You can also manage the exact amount that is paid out, whereas an annuity would pay direct to the client for the rest of their lives. This helps you manage a clients income tax position year to year. As the guaranteed income is paid into the SIPP bank account, any income not required can be easily reinvested into the drawdown account. As it never leaves the SIPP, there is no tax implication on the client. The Retirement Account can allow you to take advantage of the rise in the annuity rates through its guaranteed income option.

The changes in annuity rates have also benefitted fixed-term products. Fixed-term annuities can suit all types of clients seeking a regular income with certainty at the end of the term.

Some reasons why a client would consider a fixed-term income plan:

More details on Canada Life’s fixed-term products can be found here.

Written by Paul Speight, Head of Business Development, Canada Life.

Learn more about our flexible pension plan where your clients have the option to combine a pension drawdown and guaranteed income.

Watch our CPD webinar presented by Kevan Ramanauckis, Pension Technical Specialist.

Find out more about considerations for annuity rates as part of a retirement income solution.