- 63% of advisers report increasing client nerves about volatility

- 54% report growing concerns about investment risk

Almost three quarters (72%) of financial advisers have left their clients’ asset allocations the same throughout the volatility caused by Covid-19*. Research from Canada Life Asset Management today reveals this hands-off approach taken by advisers, with only 14% taking steps to reduce their clients’ exposure to riskier assets, such as emerging market equity or high-yield bonds.

This long-term view is mirrored by their clients’ investment goals which have also largely stayed the same, according to the research. However, client trepidation is growing with 63% of advisers saying their clients have become more fearful of volatility since the start of the year and more than half (54%) reporting increasing concern about investment risk.

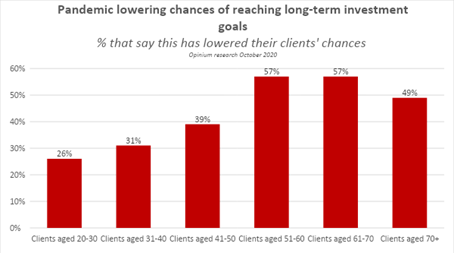

Advisers are also becoming increasingly concerned about the chances of reaching their clients’ investment goals – particularly those clients over 50 years old as they get closer to retirement.

Craig Metcalf, Head of Strategic Alliances at Canada Life Asset Management, said:

“Advisers have long memories and are adept at keeping their cool, adopting a longer-term view as they have likely navigated clients through previous market turmoil, including 2008 and the dot.com bubble.

“However, for some of their clients the pandemic has spooked them and many say they are feeling apprehensive or concerned about the safety of their investments and their likelihood of reaching their goals. As we navigate the next few weeks and look towards 2021, advisers will be making decisions to ensure their clients’ risk of exposure to markets, both upside and downside, is factored in. By adopting diverse, multi-asset strategies advisers will be positioning their clients well for future volatility.”

*Opinium research of 200 independent financial advisers between 20th - 26th October